(Drivebycuriosity) - Today oil costs about 60% less than at the peak of last year. But the majority of the US airlines had missed the price drop. In 2014 they had bought fuel a year in advance as an insurance to protect themselves from unexpected price rises (hedging). They had purchased financial instruments (calls) which guaranteed them fuel delivery in 2015 with prices of 2014. These hedges caused high losses: $1.95 billion for Delta, $650 million for United Airlines and $326 million for Southwest Airlines, reports Bloomberg (bloomberg).

But it seems that the airlines are learning: "United, Continental and Delta Air have reduced fuel hedging as oil plunged close to a six-year low; they’ve become more like American Airlines, which closed its last hedging position in 2014" (bloomberg).

Flood Insurance In The Desert

The losses the big airline had suffered this year are just one example that hedging is expensive and in most cases unnecessary. The same is true for the stock market. Many fund managers are hedging their portfolios. They are buying financial instruments, which benefit from falling stock prices (puts). If the stock market crashes as it did in 1987 and during the recessions of 2000/01 & 2008 these puts deliver gains which should compensate for the stock losses (at least partly).

As explained above hedging is an insurance and as any insurance it comes

with a cost. The insurer - in this case often a bank or a broker who

sells (writes) the puts - wants an income for her services. The insurer

takes a risk (in the case of a crash she has to buy stocks for an agreed price) and needs to be compensated for that. Therefore puts are expensive (and managing them costs time & effort). Insuring a portfolio over a whole year with puts costs about 5% of its value (wikipedia investopedia ).

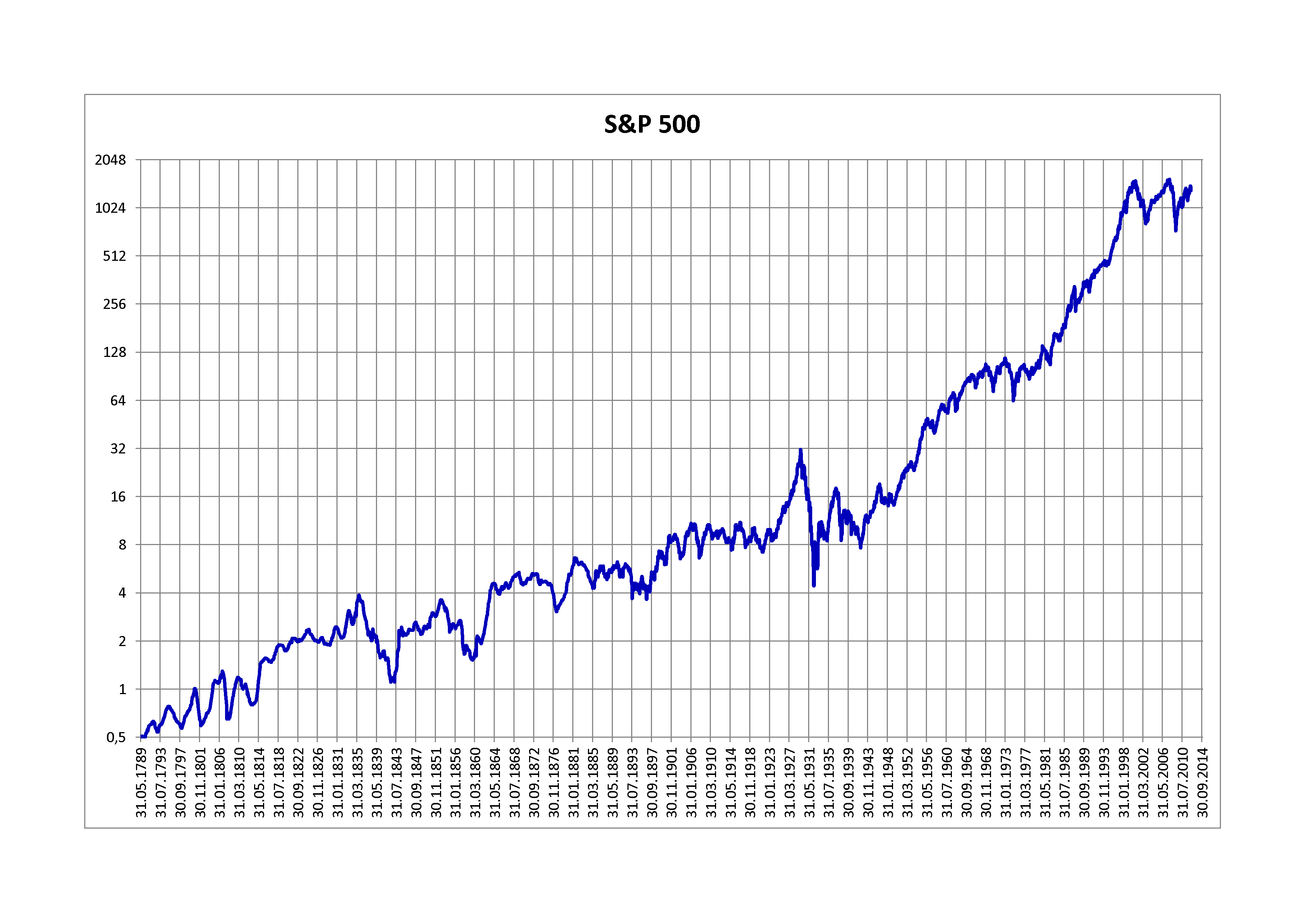

These costs are unneeded because on average - and in most of the years - the stock market has been rising. As the chart below shows, each correction & crash has been erased in the following years and most corrections were too short and too shallow to justify the high costs of hedging. So the hedging gains of the years 1998, 2000/01 and 2008 have been eaten in the following years. Long term investors don´t need hedging which creates unnecessary costs and reduces the returns. Hedging is like buying a flood

insurance for a house in a desert (there might be a flood, but very seldom).

Hedging is used - and advertised - by professionals like fund managers & stock advisers. They want to demonstrate their skills and need to justify their existence - and they don`t have to pay for the costs. Hedging is overrated!

No comments:

Post a Comment