Fortunately, 2020 started on a solid foot with record low unemployment & solid retail sales. On March 27th, the Federal Reserve Bank of Atlanta, which uses all available information, still calculated a GDP growth of 2.7% for Q1 (frbatlanta ). The final numbers will certainly be lower. According to CNBC the US economy came to a standstill in the last days of the quarter (cnbc). But here in Manhattan, where I live, grocery and other stores for necessary goods are still fluid and many restaurant & pubs are open for take out. The Internet sector seems to boom. Many work at home, use e-commerce, educate & entertain themselves on Internet. Online sales in the US are already surging. Amazon already hired 100,000 people to deal with a surge of online orders, Facebook reports explosive demand and Microsoft says that some categories of their cloud computing services jumped 775% (microsoft)! The final GDP number will show tepid growth but there will be still be a plus for the whole quarter.

The coming quarter will have a shrinking GDP thanks to the draconian measures. The question is how deep the GDP will drop. We are experiencing now an economic air pocket which will continue in April (many businesses are closed and the panic buyers will consume their huge provisions they are amassing now). There will be a sharp reduction of business investment, as in every economic downturn. But the US economy will not totally be frozen. Consumer spending for rentals could be immune to the virus and consumer expenditures for health services are spiking. Factories for necessary goods, grocery stoes and take out restaurants will continue to work. A lot people will shop on Amazon & Ebay, binge watch Netflix & Prime, listen to Spotify, read Kindle books, surf Facebook & Twitter, and businesses will run more & more on cloud computing.

The downturn will also be smoothed by the $6 trillion which is getting pumped into the US economy in the coming weeks. There is a long catalogue of measures ( reuters marketwatch). A lot of US tax payers will receive a direct payment of $1,200, with additional payments of $500 per child. The millions who lost their jobs - or will in the coming weeks - will start getting additional unemployment benefits from the federal government. Small businesses will have access to $350 billion in forgivable loans. There are programs for airlines and other big corporations and much more. And the Federal Reserve started to add about $4 trillion by giving loans & purchasing bonds.

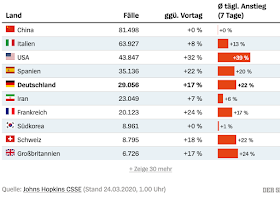

Nobody knows how long the quarantines & lock downs will last. Clearly the evidence shows that quarantines, travel bans, the temporary closing of factories & gathering places (pubs, gyms, restaurants, beaches etc), social distancing and cautious behavior (intense hand washing, fewer body contacts etc.) will flatten the curve and constrain the epidemic. Fortunately the infection curves are already flattening! On March 24 the Johns-Hopkins-University reported that the US number of cases had a daily growth of 39%. On March 31 this growth rate had dropped to 21% (tables below, red columns on the right sides). Italy, Germany, Iran and other countries are also reporting falling growth rates. In China the infections have already peaked and the country is going back to work. Warmer weather in the coming months could also help to slow the contamination ( marketwatch). It is reasonable to expect that the US infection wave will peak around Easter.

(source)

Following the experience from China, Korea & Japan we might notice some signs of economic recovery beginning in May driven by the tsunami of government money and the growing Internet sector. We might suffer a downturn over 2 or 3 months (counting from Mid-March), not the historical recession minimum of 6 months. The second half of the year should show an economic boom starting in the third quarter. There is a huge backlog demand. People are tired from sitting quarantined at home, they will be happy to go back to work and to visit shops, bars, restaurants. The recovery will be still be fueled by the $6 stimulus tsunami which works as financial steroids. There also will be strong tailwinds from record low interest rates. Oil prices dropped on a level last seen in the 1990s when cheap oil fueled a long economic upswing.

(oil price history on log-scale & inflation adjusted macrotrends )

COVID-19 might change the whole economy. We learned from China that the epidemic altered the behavior of many people. More people are working, learning & shopping from home which is fostering digitization and raising efficiency & productivity of the economy ( driveby ).

Eventually the downturn should be not longer than 3 months and the US should avoid the usual definition of a recession. But it is an election year and some groups might be happy to announce a recession.