(Drivebycuriosity) - America has now 11 years without a recession. The benign period would end if Bernie Sanders or Elizabeth Warren would become the next US president. Both candidates announced that they would ban fracking if they would be elected. This step would cause a sudden disruption of the global oil supply which would lead to a sharp recession.

( source)

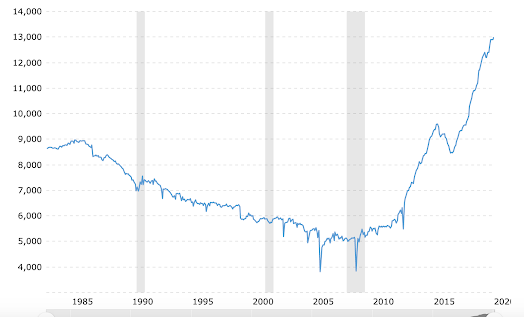

US fracking exists for many decades, but it really took off around the year 2012 thanks to technological progress (wikipedia). Since then US production of oil & natural gas rose sharply and the US became the world`s largest oil producer (chart above). Fracking helped the US to overtake Saudi Arabia as oil producer, reduced the power of Opec significantly and stabilized the global supply of energy.

( source)

As a result oil & gas prices dropped sharply. Today oil & natural gas cost about half of the price from 2012 (charts above). US fracking not only made energy much cheaper, US fracking also reduced the risk of sudden oil prices hikes which had caused most of past recessions. "Rapid increases in the price of oil have preceded almost all U.S. recessions" ( marginalrevolution ). You can see the relation between oil & recessions in the charts below (the dark columns show the recession years).

( source)

History shows that periods with cheap oil are prosperous, periods with expensive & volatile oil (like the 1970s and the 2000s) are not. The causal relation between oil and recessions can be easily explained. Americans depend on gasoline. Many live in suburbs and in the hinterland and they need to drive a lot to go to work, to shop & to spend leisure time. High prices for gasoline and natural gas (for heating, electricity) curb their available income. It is not surprising that high gas prices constrain consumer spending, the engine of the US economy.

A fracking ban would cut a large part of the US oil & gas production and catapult global markets into turmoils. Today fracking delivers about two thirds of US natural gas and around halve of US oil ( google). If this these parts would suddenly disappear then energy price would explode, hiking cost for driving, heating, electricity & transportation of food and other bulky goods sharply, hurting especially low income groups. Many would have to cut back, many would go bankrupt - causing a chain reaction like in the years 2008/09. Then the oil price had tripled ( from $50 per barrel to $147). Jumping prices for energy prices played an important role in eventually bursting the US subprime bubble: "In 2003, the average suburban household spent $1,422 a year on gasoline, which rose to $3,196 in 2008" (oilprice). "Rising household energy prices constrained household budgets and increased mortgage delinquency rates" (oilprice). Low income suburban homeowners suffered most from the rising gas prices. If a fracking ban would reduce US oil and gas production to zero, the price hike and the following crash of the economy would be even more severe.

A fracking ban would also change the global political situation drastically. America would lose her energy security and would depend again on foreign powers like Russia, Iran & Opec, which is controlled by Saudi Arabia. Saudi Arabia, Russia & Iran suppliers would be the clear winners of an US fracking ban.

No comments:

Post a Comment