(Drivebycuriosity) - I like science fiction. Unfortunately most science fiction novels disappoint. Therefore I usually skim collections of science fiction short stories to find some gems. For years I have been reading the anthology "The Year`s Best Science Fiction" edited by Gardner Dozois. His compilation has been the market leader for 3

decades and offers a kaleidoscope of plots, ideas and styles. Dozois

caters to a lot of different tastes and shows the state of art in

science fiction.

I just finished reading his "Thirty Third Annual Collection" which harvests the science fiction year 2015 (the print edition, published in July 2016, has 718 pages amazon). As usual Dozois started with a lengthy summation of important events, trends and publications in the world of science of fiction in 2015. For each story he wrote an introduction where he outlines the

background and most important works of the presented author.

Many stories didn´t hit my taste button but I enjoyed at least 9 of the almost 40 stories (25%) which seems a passable quota to me. I have 2 favorites:

"Inhuman Garbage" by Kristine Kathryn Rusch: A female detective is investigating a murder case on a moon colony. The story is a very plausible take on the possible life & the economics on the earth´s satellite and gives something to think about.

"The Audience" by Sean McMullen. Some astronauts are exploring a dark planet that had entered our sun system. Reminds me of the classics by Asimov & Clark.

I also liked:

"Three Cups of Grief, By Starlight" by Aliette de Bodard (aliettedebodard) is a kind of baroque family story based on Chinese culture & tradition set in a far future. The story is a very special & exotic reading pleasure. The compilation has a second story by this author: “Citadel of Weeping Pearls" which is not as strong.

"Today I am Paul" by Martin L. Shoemaker. The very plausible story, set in a near future, is told by a humanoid robot (Android) who has to take care of a woman with Alzheimer disease. Shoemaker describes a possible future, the question is whether we will like it.

"Gypsy" by Carter Sholz tells the experiences of some spaces travelers on their long journey to Alpha Centauri. The plot is dark & pessimistic, maybe a bit too negative, but precisely written & full of science.

"A Stopped Clock" by Madeline Ashby is set in a dystopian near-future Korea where the communication systems brakes down. I am not a big fan of dystopia but I cared about the fate of the leading character.

There are two adventure stories set on Venus: "Planet of Fear" by Paul J. McAuley & "Ruins" by Eleanor Arnason. The real Venus is a stony planet with a very dense atmosphere, but in these tales the "Venus" is very earth-like. Both plots are entertaining.

And there is another entertaining story: In “Trapping the Pleistocene" by James Sarafin. An American hunter & nonconformist is sent back in time to catch an giant beaver. It´s a traditional adventure story with just some futuristic elements, but well told.

Enjoy!

Wednesday, September 21, 2016

Saturday, September 17, 2016

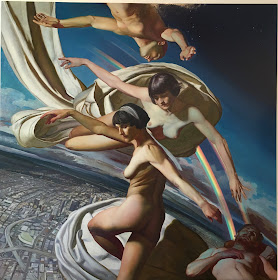

Contemporary Art: Six-Years Anniversary Group Exhibition @ Dacia Gallery, New York, NSFW

(Drivebycuriosity) - New York´s fast gentrifying Lower East Side has about 130 art galleries. On 53 Stanton Street you can find the active Dacia Gallery (daciagallery). It seems that art dealer focuses on nudes. They show now the Six-Years Anniversary Group Exhibition (through September 29, 2015). I display here my favorites, as usual a very subjective selection. Let the pictures speak for themselves.

On top of this post you can see "Jacob's Ladder" by Noah Buchanan (Oil on Panel, 48x48); followed by a paintings by Marshall Jones & Courtnery Bae.

Above artwork by Thurston E. Belmer.

Followed by work by Nick Savides, Heather Morgan & Noah Buchanan.

These nudes are created by Stefano Losi, Stephen Early (number 2+3) & Victoria Selbach.

Enjoy!

On top of this post you can see "Jacob's Ladder" by Noah Buchanan (Oil on Panel, 48x48); followed by a paintings by Marshall Jones & Courtnery Bae.

Above artwork by Thurston E. Belmer.

Followed by work by Nick Savides, Heather Morgan & Noah Buchanan.

Enjoy!

Friday, September 16, 2016

Economy: America Needs China Even More

(Drivebycuriosity) - This week we got conflicting signals front the global economic front. The US retail sales fell in August 0,3% and their year-over-year growth rate slowed to just 1.9% (calculatedrisk). But the Chinese retail sales grew 10.6% year-over-year, faster than in July (plus 10.2% tradingeconomics).

The American retail slowdown is disappointing in the face of an expanding job market, climbing wages, stock & home prices and cheap gasoline. Maybe the Americans are losing their traditional optimism. Maybe the American majority is too scared about the economy and is too timid to consume (driveby).

It seems that the Chinese consumers are replacing the Americans as the engine of the global economy. China (1.3 billion people) is swiftly transforming into a modern economy, helped by the technological progress. People are flooding into the big cites. The rapid urbanization creates millions of jobs and is driving income growth for the whole nation. Swift rising incomes are fueling the economic growth of China and so the retail sales. The rising importance of the Chinese consumers is a boon for global consumer companies like Apple, McDonald´s, Starbucks & Co. and could compensate at least of the weak American retail.

The American retail slowdown is disappointing in the face of an expanding job market, climbing wages, stock & home prices and cheap gasoline. Maybe the Americans are losing their traditional optimism. Maybe the American majority is too scared about the economy and is too timid to consume (driveby).

It seems that the Chinese consumers are replacing the Americans as the engine of the global economy. China (1.3 billion people) is swiftly transforming into a modern economy, helped by the technological progress. People are flooding into the big cites. The rapid urbanization creates millions of jobs and is driving income growth for the whole nation. Swift rising incomes are fueling the economic growth of China and so the retail sales. The rising importance of the Chinese consumers is a boon for global consumer companies like Apple, McDonald´s, Starbucks & Co. and could compensate at least of the weak American retail.

Tuesday, September 13, 2016

Economy: Don`t Underestimate China

(Drivebycuriosity) - If we believe the media China is about to crash.

But the reality refutes the gloomy predictions. Quite contrary, the recent economic data suggest that the Chinese economy is gaining traction again.

This morning we learned that the Chinese retail sales grew 10.6% in August, faster than in July (plus 10.2%). The charts below suggest that the slow down of the Chinese economy has come to an end (source tradingeconomics ). Growing retail sales are a sign that China´s consumer spending, the motor of the domestic economy, has bottomed out.

Today we also learned that China`s Industrial production accelerated as well (tradingeconomics). Another sign that China is managing the hoped soft landing which should foster the global economy.

I am not surprised. The huge country is still in the begin of a secular catching-up process which is fueled by extreme income & wealth differences to the US and other Western nation values. Today China has about $7,500 income per capita, the US number is $54,600 (worldbank). And: China is transforming into a modern economy, helped by the technological progress. People are flooding into the big cites. The rapid urbanization creates millions of jobs and is driving income growth for the whole nation. Swift rising incomes are fueling the economic growth of China. This economic environment makes a China crash highly unlikely.

PS for illustration I chose an image of Chinese top model Danni Li as an example for the modern China.

This morning we learned that the Chinese retail sales grew 10.6% in August, faster than in July (plus 10.2%). The charts below suggest that the slow down of the Chinese economy has come to an end (source tradingeconomics ). Growing retail sales are a sign that China´s consumer spending, the motor of the domestic economy, has bottomed out.

Today we also learned that China`s Industrial production accelerated as well (tradingeconomics). Another sign that China is managing the hoped soft landing which should foster the global economy.

I am not surprised. The huge country is still in the begin of a secular catching-up process which is fueled by extreme income & wealth differences to the US and other Western nation values. Today China has about $7,500 income per capita, the US number is $54,600 (worldbank). And: China is transforming into a modern economy, helped by the technological progress. People are flooding into the big cites. The rapid urbanization creates millions of jobs and is driving income growth for the whole nation. Swift rising incomes are fueling the economic growth of China. This economic environment makes a China crash highly unlikely.

PS for illustration I chose an image of Chinese top model Danni Li as an example for the modern China.

Saturday, September 10, 2016

Stock Market: Is Wall Street Irrational?

(Drivebycuriosity) - Last week Wall Street showed how irrational she can be. On Friday the S&P 500, the gauge of the US stock market, dropped suddenly 2.5%, the sharpest sell-off since the Brexit scare in June. "The summer of calm gave way to chaos," commented Barron´s (barrons). The selling was caused by the fear that the Fed could hike their interest rates soon, say the pundits.

This sell-off does make no sense nor did the Brexit selling spree and the panic selling in January & February. Brexit didn`t harm the British economy, the current economy data show that the British economy stays resilient. No wonder that the stock market erased the dent in few days. Neither was the January/February selling panic - caused by fears of deflation, negative interest rates, crashing oil prices and an allegedly tanking Chinese economy - justified. These selling sprees were irrational and fostered by the herding behavior of the hedge funds (and those who follow them). Those speculators buy and sell the same stocks, at the same time, and track each other's investment strategies.

I suppose that last week´s stock market response was irrational as well. The fears from January & February have disappeared. Now the market doesn´t fear falling interest rates, now she fears quite the opposite. One fear has displaced the other. Yes, the Fed may hike soon, so what. The Fed only will hike when she believes that the global economy is getting better, and the next rate hike will be modest, maybe just plus 0.25 percent points. So interest rates will stay abnormal low. History shows that such small interest rates moves don´t slow the economy.

This sell-off does make no sense nor did the Brexit selling spree and the panic selling in January & February. Brexit didn`t harm the British economy, the current economy data show that the British economy stays resilient. No wonder that the stock market erased the dent in few days. Neither was the January/February selling panic - caused by fears of deflation, negative interest rates, crashing oil prices and an allegedly tanking Chinese economy - justified. These selling sprees were irrational and fostered by the herding behavior of the hedge funds (and those who follow them). Those speculators buy and sell the same stocks, at the same time, and track each other's investment strategies.

I suppose that last week´s stock market response was irrational as well. The fears from January & February have disappeared. Now the market doesn´t fear falling interest rates, now she fears quite the opposite. One fear has displaced the other. Yes, the Fed may hike soon, so what. The Fed only will hike when she believes that the global economy is getting better, and the next rate hike will be modest, maybe just plus 0.25 percent points. So interest rates will stay abnormal low. History shows that such small interest rates moves don´t slow the economy.

Contemporary Art: Landscapes & Abstracts @ Artifact, New York

(Drivebycuriosity) - New York´s Lower East Side has about 130 art dealers. Gallery Artifact on 84 Orchard Street (artifactnyc) belongs to my favorites. The art dealer has frequently new interesting shows, often with 3 and more strong artists.

Here are my favorites from the current exhibition, as usual a very subjective selection. Let the pictures speak for themselves. Above you can see some landscapes by Wolfgang Hock.

Above paintings by Martin Pawera.

Above some abstracts by Dragoslava Stankovic.

Enjoy!

Here are my favorites from the current exhibition, as usual a very subjective selection. Let the pictures speak for themselves. Above you can see some landscapes by Wolfgang Hock.

Above paintings by Martin Pawera.

Above some abstracts by Dragoslava Stankovic.

Enjoy!

Friday, September 9, 2016

Economy: When Will The Irish Leave the EU?

(Drivebycuriosity) - Is the Republic of Ireland still an independent country? Recent developments cast some doubts. Last week the EU nixed a deal between Ireland and Apple. The European Commission, the EU's executive arm, ordered Apple to pay $14.5 billion in taxes to Ireland. In 1990 Apple entered into a deal with Ireland to pay very low taxes there. In return Apple promised to create a lot of jobs there. It seems that both were happy with this deal, but not the EU. "Low corporate tax was one way Ireland improved its economy and attracted big companies, and Apple was one of the early companies to benefit", explains BusinessInsider (businessinsider).

Does a government has the right to decide about taxes? Will the Irish loose jobs because the EU says so?

The verdict shows how much power Brussels (the seat of the EU Commission) has gained and how strong the EU interferes in the politics of the member countries. It looks like that the European Union is developing into something like the defunct Soviet Union, a bundle of states ruled by a central government.

The growing power of the EU Commission over national policies - and the loss of democracy in the member countries - was one of the reasons for Brexit. Maybe the Irish will follow the British example and leave the EU as well.

Does a government has the right to decide about taxes? Will the Irish loose jobs because the EU says so?

The verdict shows how much power Brussels (the seat of the EU Commission) has gained and how strong the EU interferes in the politics of the member countries. It looks like that the European Union is developing into something like the defunct Soviet Union, a bundle of states ruled by a central government.

The growing power of the EU Commission over national policies - and the loss of democracy in the member countries - was one of the reasons for Brexit. Maybe the Irish will follow the British example and leave the EU as well.

Tuesday, September 6, 2016

Contemporary Art: A Visit @ Governors Island Art Fair 2016

(Drivebycuriosity) - New York City is a paradise for art lovers. There are so many art shows & events. One of them is the Governors Island Art Fair 2016 (4heads). The event happens on a tiny island south of Manhattan (5 minutes ferry ride) on every weekend in September (here my reports from 2014 2015 I 2015 II ).

The astronaut above (oil on linen) is created by Aleksandar Popovic (apopovic).

Above some paintings by E. Thurston Belmer (ethurstonbelmer).

The drawing above is China ink on British white scratch- board (about 20 inches by 24 inches) by Scott Gillis (scottgillis).

Above another drawing, this one is by Antonia Andrioti (antoniaandrioti).

Appealing Abstracts

There also were some appealing abstracts. Above works by Ed Grant (edgrantworks).

Abstracts by Vince Contarino (Acrylic on canvas vincecontarino ) & Chris Chatterson (Acrylic and transfer on canvas kchatterson) also caught my eyes.

Funny Collages

I enjoyed the funny collages by Bernice Sokol Kramer as well (bernicesokolkramer).

Butcher`s Daughter

"When I was young, my parents owned a butcher shop", explains the Korean artist Seungwhui Koo her pig-shaped sculptures & drawings (kooseunghwui).

Enjoy!