These vehicles will get cheaper in the coming years thanks to technological progress, competition and mass production - and they will become common in the 2020s. Then the new car revolution will curb the demand for gasoline considerably. Bad for Opec because crude oil is mainly use to produce gasoline. The chart below (source bloomberg) shows that oil is already irrelevant as power source for electricity production: Just one percent of the US electricity comes from petroleum.

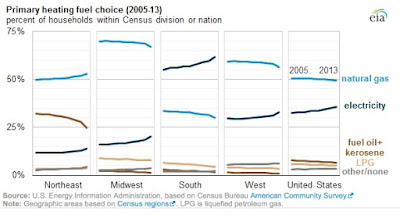

It´s similar with heating (chart below: source eia.gov/). Less than 20% of US households use oil for heating, the majority is heating with natural gas and electricity (produced mainly by coal & natural gas).

So, most of the oil - about 70% - is used for transportation and around 30% for petrochemical products ( energy).

But it will get worse for Opec. The cartel also has to fight against a rising competition. Technological progress is making more of the oil reserves in the ground accessible. The rise of US fracking from around 2006 through 2015 is just the begin. Today the costs to extract an extra barrel of oil (break even point) in the US vary around $60 - with a range of range from around $40 to more than $70 a barrel (marketwatch). At current oil prices - in the moment of writing the US Type of oil WTI costs about $37 - many wells are unprofitable and are getting shut off. This explains the slight drop of US oil production since last summer. But, the productivity of fracking is rising swiftly which leads to shrinking costs (economics21 oilprice econbrowser). A study by BP explains that fracking is "a standardized, repeated, manufacturing process" and "manufacturing productivity has led to a trend decline in the prices of goods relative to services" (forbes).

So the break even point for producing oil has been moving lower and will continue to fall in the coming years. Falling costs of fracking also raise the chance that in the coming years the US oil producers will be accompanied by oil producers from China and other countries. In June 2013, the United States Energy Information Administration (EIA) released a world shale oil and gas reserve assessment that showed 32 countries outside the United States have substantial reserves locked up in 137 different formations - units that can be exploited using Bakken-like technology....The EIA placed China third behind Russia and the U.S. in tight shale (tribune ).

After 2020 oil prices could fall well below $20 thanks to sinking production costs and a shrinking gasoline demand. Saudi Arabia and other big producers, who are sitting on huge oil reserves that should last many decades, would be well advised to sell their oil now. Maybe the advent of electrical cars - in combination with the evolution of fracking - is the real reason for the recent oil price collapse.

No comments:

Post a Comment