(Drivebycuriosity) - Today oil costs about 60% less than at the peak of last year. But the majority of the US airlines had missed the price drop. In 2014 they had bought fuel a year in advance as an insurance to protect themselves from unexpected price rises (hedging). They had purchased financial instruments (calls) which guaranteed them fuel delivery in 2015 with prices of 2014. These hedges caused high losses: $1.95 billion for Delta, $650 million for United Airlines and $326 million for Southwest Airlines, reports Bloomberg (bloomberg).

But it seems that the airlines are learning: "United, Continental and Delta Air have reduced fuel hedging as oil plunged close to a six-year low; they’ve become more like American Airlines, which closed its last hedging position in 2014" (bloomberg).

Flood Insurance In The Desert

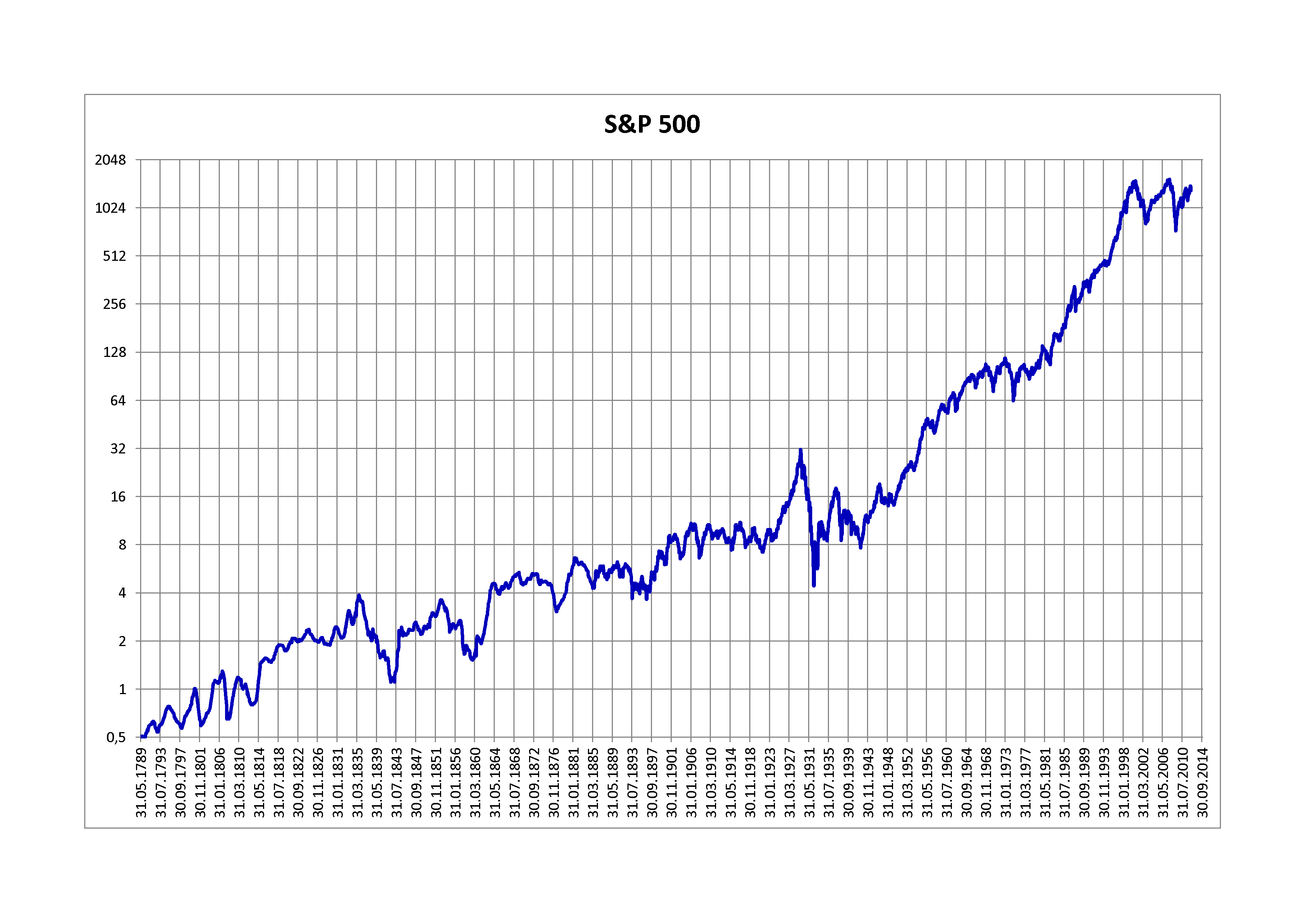

The losses the big airline had suffered this year are just one example that hedging is expensive and in most cases unnecessary. The same is true for the stock market. Many fund managers are hedging their portfolios. They are buying financial instruments, which benefit from falling stock prices (puts). If the stock market crashes as it did in 1987 and during the recessions of 2000/01 & 2008 these puts deliver gains which should compensate for the stock losses (at least partly).

As explained above hedging is an insurance and as any insurance it comes

with a cost. The insurer - in this case often a bank or a broker who

sells (writes) the puts - wants an income for her services. The insurer

takes a risk (in the case of a crash she has to buy stocks for an agreed price) and needs to be compensated for that. Therefore puts are expensive (and managing them costs time & effort). Insuring a portfolio over a whole year with puts costs about 5% of its value (wikipedia investopedia ).

These costs are unneeded because on average - and in most of the years - the stock market has been rising. As the chart below shows, each correction & crash has been erased in the following years and most corrections were too short and too shallow to justify the high costs of hedging. So the hedging gains of the years 1998, 2000/01 and 2008 have been eaten in the following years. Long term investors don´t need hedging which creates unnecessary costs and reduces the returns. Hedging is like buying a flood

insurance for a house in a desert (there might be a flood, but very seldom).

Hedging is used - and advertised - by professionals like fund managers & stock advisers. They want to demonstrate their skills and need to justify their existence - and they don`t have to pay for the costs. Hedging is overrated!

Monday, November 30, 2015

Sunday, November 29, 2015

Books: The Cement Garden By Ian McEwan

(Drivebycuriosity) - The novel "The Cement Garden" by Ian McEwan has been on my radar for many years. In the year 1978, when the book got published, the novel made a splash because of the provoking plot. Finally I read the small book (just 138 pages amazon) and enjoyed the weird but gripping story (this is a spoiler free blog. You can find an elaborate analyses here literature ).

The novel is a very dark family story, maybe the novel´s message is: "Family first", even that the protagonists went way to far. The story is about Julie, who is 17, Jack (15), Sue (13) & Tom ( around 6). The book is written in first person and narrated by the pubescent Jack, which is part of the challenges of the book. The kids live isolated in a house in an abandoned area far from the civilization. Early in the book their live changes dramatically which starts a chain of events which get more & more disturbing.

McEwan created a strange and unique - almost exotic - atmosphere that reminds me a bit of Daniel Defoe`s Robin Crusoe even that the plots are very different. It is a psychological thriller about adolescents in an extreme situation and touches topics like adolescence, puberty, family bindings, exploring sexuality, dilapidation, grief, curiosity and more.

I admire McEwan`s economic but eloquent style. His precise & analytical observations and his almost forensic descriptions remind me also of Nabokov´s Lolita. I could see strong influences from Sigmund Freud, especially the scientist´s insights into the maturation of sexuality. The frequent descriptions of the sexual aspects are intense & honest and belong to the most erotical and poetic I have ever read.

"The Cement Garden" is still an exciting read after all these years. The book is a distburbing masterpiece and belongs to the canon of world literature.

P.S. For illustration I used still from the 1993 same named film with Charlotte Gainsbourg.

The novel is a very dark family story, maybe the novel´s message is: "Family first", even that the protagonists went way to far. The story is about Julie, who is 17, Jack (15), Sue (13) & Tom ( around 6). The book is written in first person and narrated by the pubescent Jack, which is part of the challenges of the book. The kids live isolated in a house in an abandoned area far from the civilization. Early in the book their live changes dramatically which starts a chain of events which get more & more disturbing.

McEwan created a strange and unique - almost exotic - atmosphere that reminds me a bit of Daniel Defoe`s Robin Crusoe even that the plots are very different. It is a psychological thriller about adolescents in an extreme situation and touches topics like adolescence, puberty, family bindings, exploring sexuality, dilapidation, grief, curiosity and more.

I admire McEwan`s economic but eloquent style. His precise & analytical observations and his almost forensic descriptions remind me also of Nabokov´s Lolita. I could see strong influences from Sigmund Freud, especially the scientist´s insights into the maturation of sexuality. The frequent descriptions of the sexual aspects are intense & honest and belong to the most erotical and poetic I have ever read.

"The Cement Garden" is still an exciting read after all these years. The book is a distburbing masterpiece and belongs to the canon of world literature.

P.S. For illustration I used still from the 1993 same named film with Charlotte Gainsbourg.

Saturday, November 28, 2015

Contemporary Art: Appealing Nudes @ Dacia Gallery, New York

(Drivebycuriosity) - Contemporary art has many faces. Many artists create abstract compositions, others compose figurative images. There is still a large group who focuses on painting appealing nudes. Some of them you can spot @ the active Dacia Gallery on New York´s fast gentrifying Lower East Side (53 Stanton Street daciagallery) has a show with paintings & drawings by Patricia Watwood, called "New Narratives" (through December 13, 2015).

On top of this post you can see "The Sixth Extinction" ($45,000). The press release says: "The three women are allegorical figures: Gaia, the primordial earth goddess, a caryatid and a naiad - all classic characters drawn from the history of art and cast to symbolize humanity’s precarious position."

Below "Pink Sybil" ($4,000 ) followed by "Eurycle in the Under World" (detail):

I also like her drawings: "Lunette I" ($1,800) followed by "Fallen Caryatid II (bridge); "Fallen Caryatid III (factory)" ($,2400) & "Fallen Caryatid I (snake)" each $,2400:

Enjoy!

On top of this post you can see "The Sixth Extinction" ($45,000). The press release says: "The three women are allegorical figures: Gaia, the primordial earth goddess, a caryatid and a naiad - all classic characters drawn from the history of art and cast to symbolize humanity’s precarious position."

Below "Pink Sybil" ($4,000 ) followed by "Eurycle in the Under World" (detail):

I also like her drawings: "Lunette I" ($1,800) followed by "Fallen Caryatid II (bridge); "Fallen Caryatid III (factory)" ($,2400) & "Fallen Caryatid I (snake)" each $,2400:

Enjoy!

Movies: Why "The Secret In Their Eyes" Is Such A Failure

(Drivebycuriosity) - Sometimes a movie is very disappointing even when the cast is spiced with big names. The film "The Secret in Their Eyes" is one of these failures (imdb). The prestigious cast - Julia Roberts, Nicole Kidman, Dean Norris (from "Breaking Bad"), Michael Kelly & Chiwetel Ejiofor - couldn´t save the weak project.

A girl got raped & murdered but the investigation gets hampered by a conflicting anti terror probe (this is a spoiler free blog). The plot is over-constructed, unbelievable and has to many logical gaps. Many alleged connections didn´t work.

"The Secret" is the remake of an Argentinian movie which earned in 2009 the Oscar as best foreign language movie of the year. The producers adapted the plot to the contemporary US but ruined the story totally. It seems that the makers thought that bringing together Kidman, Ejiofor & Roberts is a bankable idea, but that didn´t work out.

I consoled myself by focusing on Nicole Kidman. Apparently the plot was constructed around her sex appeal with no regard to the basic story. Her colleague Julia Roberts would have deserved a better film as well. But even rich persons can (and want to) get richer.

Sorry, Roberts, Kidman & Co. you didn´t do a favor to your fans.

A girl got raped & murdered but the investigation gets hampered by a conflicting anti terror probe (this is a spoiler free blog). The plot is over-constructed, unbelievable and has to many logical gaps. Many alleged connections didn´t work.

"The Secret" is the remake of an Argentinian movie which earned in 2009 the Oscar as best foreign language movie of the year. The producers adapted the plot to the contemporary US but ruined the story totally. It seems that the makers thought that bringing together Kidman, Ejiofor & Roberts is a bankable idea, but that didn´t work out.

I consoled myself by focusing on Nicole Kidman. Apparently the plot was constructed around her sex appeal with no regard to the basic story. Her colleague Julia Roberts would have deserved a better film as well. But even rich persons can (and want to) get richer.

Sorry, Roberts, Kidman & Co. you didn´t do a favor to your fans.

Friday, November 27, 2015

Economy: Christmas Shopping - With A Little Help From The Gas Pump

(Drivebycuriosity) - Today is "Black Friday", the inofficial start of the Christmas shopping season in the US (holiday business). Fortunately gasoline prices are falling - thanks to the global oil flood. Today gas at the pump (national average price) costs $2.05, about 6% less than one month ago ($2,20) and around 30% less than a year ago ($ 2.80) (fuelgaugereport). It seems that gas prices are coming back to the level they had before the year 2003 (chart below).

I think that the gas price drop comes right in time for the holiday season. Falling gas prices work like a tax cut. Consumers have more money to spend for other goods and services than last year. Especially commuters who have a monthly gas bill of $100 and more are benefitting from the 30% price reduction. Cheaper gasoline - in combination with a stronger job market - weekly jobless claims on 40-years-low and U.S. paychecks were 4.9 percent higher in October than they were a year earlier (crainsdetroit) - should fuel the consumer spending in the coming days.

The chart below this paragraph - which shows the yearly growth rates of the US retail sales (ex-gasoline) - can partly be explained with the influence of the gas prices. Before the year 2000 gas prices hovered below $2. Cheap gas stimulated the retail sales which`s growth rate fluctuated between 4% and 8%. After the recession 2001/02 and the 9/11 incident retail sales recovered temporarely to a growth rate of around 8%. The sharp rise of the gas prices - beginning in 2003 - slowed retail sales markedly. Therefore the growth of the retail sales decelerated sharply even before the recession of 2008! After 2010 the return of gas prices above $3 slowed retail sales again.

It is highly likely that the national average gas price will drop below $2 in December and will stay there for years to come because the oil flood will continue and will curb the price of crude oil (driveby). Gas prices around or below $2 for years should stimulate economic growth and bring back retail sale growth rates of 6% and more.

The chart below this paragraph - which shows the yearly growth rates of the US retail sales (ex-gasoline) - can partly be explained with the influence of the gas prices. Before the year 2000 gas prices hovered below $2. Cheap gas stimulated the retail sales which`s growth rate fluctuated between 4% and 8%. After the recession 2001/02 and the 9/11 incident retail sales recovered temporarely to a growth rate of around 8%. The sharp rise of the gas prices - beginning in 2003 - slowed retail sales markedly. Therefore the growth of the retail sales decelerated sharply even before the recession of 2008! After 2010 the return of gas prices above $3 slowed retail sales again.

It is highly likely that the national average gas price will drop below $2 in December and will stay there for years to come because the oil flood will continue and will curb the price of crude oil (driveby). Gas prices around or below $2 for years should stimulate economic growth and bring back retail sale growth rates of 6% and more.

Thursday, November 26, 2015

Culture: Tidbits From A Short Visit @ Museum Of Fine Arts, Boston

(Drivebycuriosity) - When I visit a city I like to go her art museums. Last weekend I used my short trip to Boston to see the Museum Of Fine Arts (mfa). The institution has a remarkable large and well sorted collection. Unfortunately I had not much time so I could just pick some delicatessen.

Being a connoisseur for contemporary art I focused on their collection of contemporary art which is quite impressive. Below you can see"Jessica" (2012, oil on canvas) by Chantal Joffe (google). The British painter (born 1967) spezializes in portraits of women. This picture shows Jessica Chastain, even that I didn´t recognize the actress. The painting was made via computer screen from a live video chat on skype.

Below "Untitled" (1998, oil on canvas) by the Argentinian painter Guillermo Kuitca; followed by "Retinas" (1998, two gelatin silver prints) by Gary Schneider.

Below "Double Blue Barbra (The Jewish Jackie Series)" (1992, silkscreen ink on synthetic polymer paint on canvas) by Deborah Kass, who was apparently inspired by Andy Warhol plus "Manjushri" (2005-07, unique carbon color print on Zerkall paper) by Doug and Mike Starn.

I also took a short look into their classical collection:

Enjoy!

Being a connoisseur for contemporary art I focused on their collection of contemporary art which is quite impressive. Below you can see"Jessica" (2012, oil on canvas) by Chantal Joffe (google). The British painter (born 1967) spezializes in portraits of women. This picture shows Jessica Chastain, even that I didn´t recognize the actress. The painting was made via computer screen from a live video chat on skype.

Below "Untitled" (1998, oil on canvas) by the Argentinian painter Guillermo Kuitca; followed by "Retinas" (1998, two gelatin silver prints) by Gary Schneider.

Below "Double Blue Barbra (The Jewish Jackie Series)" (1992, silkscreen ink on synthetic polymer paint on canvas) by Deborah Kass, who was apparently inspired by Andy Warhol plus "Manjushri" (2005-07, unique carbon color print on Zerkall paper) by Doug and Mike Starn.

I also took a short look into their classical collection:

Enjoy!

Wednesday, November 25, 2015

Economy: In Praise Of The Oil Flood

Some pundits claim that if the price of oil will fall below $30 we are headed to a global recession (marketwatch). That`s quite nonsense. Quite contrary, an oil price below $30 would be a great boon for the global economy.

What Does History Tell Us?

Falling oil prices work like a tax cut. Consumers have more money to spend for other goods & services. Dropping energy prices translate into lower transport costs - thanks to cheaper Diesel - which lead to lower prices for food and other goods. They also reduce the cost to produce steel, cement and many other energy intense goods. Many things which are made from oil, like cleaning fluids, laundry detergents, paint, pharmaceuticals, cosmetics, hygiene products, diapers & plastics, also get cheaper. So, cheap oil translates into low inflation which allows low interest rates.

History shows that periods with cheap oil are periods of economic prosperity while oil price jumps are usually followed by recessions. In the early 1970s the oil price jumped because OPEC cut production sharply (chart above). This lead to two recessions and decade of stagnation. In the first half of the 1980s the oil price collapsed because Saudi Arabia flooded the markets (as today). This induced a period of cheap oil and other commodities till around 2003. Cheap commodities in combination with falling interest rates and a technological revolution (Internet) lead then to a period of prosperity (with the exception of 1992 as the first Iraq war caused an oil price spike which caused a mild and short-lived recession), the longest boom in U.S. history (factcheck). In 2003 the price of oil started to climb again because of the Iraq war, other conflicts in Middle East and a massive financial speculation in commodities (driveby). The price of oil peaked at $146 in summer 2008, followed by a sharp recession (econbrowser). The high oil prices from 2009 through 2014 (above $110) were accompanied by a sluggish economy.

The current oil flood and the return of cheaper oil reminds of the mid 1980s, which was he begin of an epoch of economic prosperity with low inflation & interest rates. I believe that the current oil flood will continue thanks to the technological progress which raises efficiency and reduces cost of oil production. Cheap and abundant oil will fuel another period of global economic growth. Enjoy.

Tuesday, November 24, 2015

Culture: Boston`s Institute Of Contemporary Art Becomes Nostalgic

(Drivebycuriosity) - Boston is a city with a lot of tradition. But there is place that focuses on modernity - The Institute Of Contemporary Art. At my first visit in December 2013 I saw there a lot of fascinating paintings (here my report driveby).

Last weekend I revisited the museum but I got disappointed. It seems that the museum became nostalgic. This time they focused on a historical show: "Leap before you Look: Black Mountain College 1933-1957" (icaboston). Most of the galleries displayed art works created by students of a small school in North Carolina who caught taught a variety of arts.

Some of the students became famous. Below you can see "Painting" (1952, oil on canvas) by Franz Kline who taught at Black Mountain College in 1952; followed by "Untitled" (1950, Enamel on Fiberboard) by Robert Rauschenberg; "Yardstick" (1948, Oil and enmel on canvas) by Pat Passlof & "Min-oe" (1951, Bitumen and oil-based house paint on canvas) by Cy Twombly, who was a student at Black Mountain College in the summer of 1951.

The paintings all look a bit sad. Maybe the "Black Mountains College" was a sad place. I really missed the flamboyant and friendly paintings I spotted there in 2013 (driveby).

Fortunately the museum showed still some contemporary works from her collection. Below you can see "Czech Modernism Mirrored and Reflected Infinitely" (2005, Mirrored glass case with hand-blown mirrored glass objects) by Josiah McElheny.

Enjoy.

Last weekend I revisited the museum but I got disappointed. It seems that the museum became nostalgic. This time they focused on a historical show: "Leap before you Look: Black Mountain College 1933-1957" (icaboston). Most of the galleries displayed art works created by students of a small school in North Carolina who caught taught a variety of arts.

Some of the students became famous. Below you can see "Painting" (1952, oil on canvas) by Franz Kline who taught at Black Mountain College in 1952; followed by "Untitled" (1950, Enamel on Fiberboard) by Robert Rauschenberg; "Yardstick" (1948, Oil and enmel on canvas) by Pat Passlof & "Min-oe" (1951, Bitumen and oil-based house paint on canvas) by Cy Twombly, who was a student at Black Mountain College in the summer of 1951.

The paintings all look a bit sad. Maybe the "Black Mountains College" was a sad place. I really missed the flamboyant and friendly paintings I spotted there in 2013 (driveby).

Fortunately the museum showed still some contemporary works from her collection. Below you can see "Czech Modernism Mirrored and Reflected Infinitely" (2005, Mirrored glass case with hand-blown mirrored glass objects) by Josiah McElheny.

Enjoy.

Monday, November 23, 2015

Books: The Best American Mystery Stories 2015

(Drivebycuriosity) - I like to read mystery short stories. The best of them are crisp, compact and focused - and you don´t have to wait to long for the solution. I just finished reading "The Best American Mystery Stories 2013" (amazon). The anthology collects 20 stories with an average length of about 20

pages. The editors Otto Penzler, who selected a short list of 50

stories, and James Patterson, who choose the finalists, did a fine

job.

My favorite tale is "Staircase to the Moon" by Theresa E. Lehr. The story is set in Australia and is told by a young woman, a pearl diver and daughter of Japanese immigrants. She wants to find out who had murdered her sister. I enjoyed the style and got emotional involved into the plot.

There are 8 more stories which I liked:

"The Snow Angel" by Doug Allen. An underaged girl was found dead in the snow at a mansion where a group of privileged kids had a party in the night before. A subtile psychological tale with a lot of twists.

"Cowboy Justice" by Andrew Bourelle. 2 brothers, kind of rednecks, want to revenge the death of the 3rd brother, who got killed by drug dealers. A violent and bloody clash of cultures.

"Wet with Rain" by Lee Child. Two Americans came to an Irish town where they want to buy a house, offering a very generous price. What do the really intend? The story starts slowly but accelerates.

"Red Eye" by Michael Connelly & Dennis Lehan. A young girl had disappeared in Boston. A local detective and a cop from California try to find here. The story is told bit in the style of the old masters like Chandler & Hammett.

"Harm and Hammer" by Joeseph D`Agnese. A woman, who lives in witness protection, tries to create a total new life. Not much is happening here, but I enjoyed the precise descriptions how she deals with the new circumstances.

"Crush Depth" by Brendan Dubois. Boston again: A man goes weekly to the harbor where he talks with a man who uses to sit there. with a retired worker of the ship yard there. The dialog partner seems to have a dark secret.

"Molly´s Plan" by John M.Floyd. A man wants to rob a bank, which allegedly nobody robs. A nice story told with some humor. It´s fun to read.

"Shared Room on Union" by Steven Heighton. A story about a couple who made a very unsettling experience. An intense and claustrophobic tale.

In the moment of writing Amazon.com offers the Kindle version for just $9,99. The collection is highly recommended for connoisseurs of mystery stories and for those who want to get a taste of contemporary thrillers.

My favorite tale is "Staircase to the Moon" by Theresa E. Lehr. The story is set in Australia and is told by a young woman, a pearl diver and daughter of Japanese immigrants. She wants to find out who had murdered her sister. I enjoyed the style and got emotional involved into the plot.

There are 8 more stories which I liked:

"The Snow Angel" by Doug Allen. An underaged girl was found dead in the snow at a mansion where a group of privileged kids had a party in the night before. A subtile psychological tale with a lot of twists.

"Cowboy Justice" by Andrew Bourelle. 2 brothers, kind of rednecks, want to revenge the death of the 3rd brother, who got killed by drug dealers. A violent and bloody clash of cultures.

"Wet with Rain" by Lee Child. Two Americans came to an Irish town where they want to buy a house, offering a very generous price. What do the really intend? The story starts slowly but accelerates.

"Red Eye" by Michael Connelly & Dennis Lehan. A young girl had disappeared in Boston. A local detective and a cop from California try to find here. The story is told bit in the style of the old masters like Chandler & Hammett.

"Harm and Hammer" by Joeseph D`Agnese. A woman, who lives in witness protection, tries to create a total new life. Not much is happening here, but I enjoyed the precise descriptions how she deals with the new circumstances.

"Crush Depth" by Brendan Dubois. Boston again: A man goes weekly to the harbor where he talks with a man who uses to sit there. with a retired worker of the ship yard there. The dialog partner seems to have a dark secret.

"Molly´s Plan" by John M.Floyd. A man wants to rob a bank, which allegedly nobody robs. A nice story told with some humor. It´s fun to read.

"Shared Room on Union" by Steven Heighton. A story about a couple who made a very unsettling experience. An intense and claustrophobic tale.

In the moment of writing Amazon.com offers the Kindle version for just $9,99. The collection is highly recommended for connoisseurs of mystery stories and for those who want to get a taste of contemporary thrillers.

Sunday, November 22, 2015

Contemporary Art: With A Little Help Of The 3D Printer @ Gallery Kansas, New York

(Drivebycuriosity) - It seems that artists are under a lot of competitve pressures these days. Some use new technologies like 3D printers to distinguish themselves. You could see that for instance @ gallery Kansas in New York`s Lower East Side (210 Rivington Street kansasgallery). The art dealer is showing shows works by Ethan Greenbaum. The exhibition is called "Flats" (through December 20, 2015).

From the press release: "Greenbaum uses a range of digital and sculptural processes to excavate and reframe the built environment. In some of his works the artist has printed photographs onto both sides of transparent panels, resulting in a dense layering of figure and ground. The final work is embossed with a low relief impression of ceiling tiles - topographical surfaces similarly used to mask the internal wiring and pipe work in many buildings."

"Greenbaum also expands series of low-relief 3D powder prints, increasing their scale and incorporating them within an architectural installation of vinyl wrapped wooden studs. The prints begin with dimensional scans of building materials like insulating foam, wood and ceiling tiles - often the same items used as molds in his vacuum forms. The scans are then wrapped or engraved with architectural imagery or logos recreated from building supply brands. "

The press release also tells: "The artist's newest series of photographs on carved Corian are pulled from his archive of cell phone photos. Using 3D modeling programs, Greenbaum converts the images into dimensional surfaces that are then chiseled into sheets of Corian using a computer controlled router. The same photograph that generated the relief is then transferred onto the surface using a flatbed printer. "

I think the result of these complicated process look appealing.

Enjoy!

From the press release: "Greenbaum uses a range of digital and sculptural processes to excavate and reframe the built environment. In some of his works the artist has printed photographs onto both sides of transparent panels, resulting in a dense layering of figure and ground. The final work is embossed with a low relief impression of ceiling tiles - topographical surfaces similarly used to mask the internal wiring and pipe work in many buildings."

"Greenbaum also expands series of low-relief 3D powder prints, increasing their scale and incorporating them within an architectural installation of vinyl wrapped wooden studs. The prints begin with dimensional scans of building materials like insulating foam, wood and ceiling tiles - often the same items used as molds in his vacuum forms. The scans are then wrapped or engraved with architectural imagery or logos recreated from building supply brands. "

The press release also tells: "The artist's newest series of photographs on carved Corian are pulled from his archive of cell phone photos. Using 3D modeling programs, Greenbaum converts the images into dimensional surfaces that are then chiseled into sheets of Corian using a computer controlled router. The same photograph that generated the relief is then transferred onto the surface using a flatbed printer. "

I think the result of these complicated process look appealing.

Enjoy!

Saturday, November 21, 2015

Stock Market: How Wall Street Stopped Worrying And Came To Love The Interest Rate Hike

(Drivebycuriosity) - Last week the US stock market gained about 3%. Most of the gains came after the Federal Reserve had published her Fed Minutes: The protocol of the latest Fed meeting declared that the "conditions needed to trigger the first interest rate hike in nearly a

decade could "well be met" by their next meeting in December" (abcnews). It seems that Wall Street stopped worrying and came to love the interest rate hike.

I think the announcement triggered a stock market rally:

- The interest rate move is already priced into the stock prices. Speculations on a possible rate hike had the stock market paralyzed this year and the S&P 500, the gauge of the US stock market, stayed almost unchanged year-to-date. Many funds and other traders with a short time horizon have sold stocks or are sitting on the sidelines because of the continuous talk about a possible interest rate raise.

- The rate hike will be modest, maybe just plus 0.25 percent points. So even if the Fed hikes the interest rates will stay abnormal low. History shows that such small moves don´t slow the economy.

- The Fed move could be seen as a sign of economic strength and that the Fed sets trust into the economic upswing. This commitment could soothe the fears and calm the markets. Returning confidence should attract buyers.

- The step should reduce the uncertainty and create some clarity - at least for the moment. Funds and other traders who avoided stocks because of the interest rate hike talk could come back.

It is highly likely that last week´s gains are the begin of a year-end rally which could drive stock prices (S&P 500) north of 2, 200 by end of the year.

Enjoy.

I think the announcement triggered a stock market rally:

- The interest rate move is already priced into the stock prices. Speculations on a possible rate hike had the stock market paralyzed this year and the S&P 500, the gauge of the US stock market, stayed almost unchanged year-to-date. Many funds and other traders with a short time horizon have sold stocks or are sitting on the sidelines because of the continuous talk about a possible interest rate raise.

- The rate hike will be modest, maybe just plus 0.25 percent points. So even if the Fed hikes the interest rates will stay abnormal low. History shows that such small moves don´t slow the economy.

- The Fed move could be seen as a sign of economic strength and that the Fed sets trust into the economic upswing. This commitment could soothe the fears and calm the markets. Returning confidence should attract buyers.

- The step should reduce the uncertainty and create some clarity - at least for the moment. Funds and other traders who avoided stocks because of the interest rate hike talk could come back.

It is highly likely that last week´s gains are the begin of a year-end rally which could drive stock prices (S&P 500) north of 2, 200 by end of the year.

Enjoy.

Friday, November 20, 2015

Urbanism: Go Vertical - What We Could Learn From Singapore

(Drivebycuriosity) - Rents are rising, especially in New York City, London, San Franciso and other popular cities. The causes are clear: Many people want to migrate to these metropolises and many investors want to buy there real estate. But these cities have just a limited supply of land. Therefore real estate prices and rents are going up.

But is the supply really limited? In New York City you can see a lot of new towers which multiply the number of available apartments per square foot (driveby). Going vertical seems to be the answer to the rising demand for the limited supply of land. But the new skyscrapers in Manhattan are build for a very wealthy clientel and therefore expensive too. There are cheaper solutions as you also can spot in New York City and many other cities. But these affordable tenement towers are often ugly and unpopular.

It seems that Singapore has the solution. A "vertical village" in city-state has been named the World Building of the Year (independent). "Judges at the eighth annual World Architecture Festival, held in Singapore, awarded the top prize to "The Interlace". The village, designed by the Office for Metropolitan Architecture and Buro Ole Scheeren was praised for its “radical and alternative” approach" (image above). "The building contains 31 ‘stacked’ residential blocks and is six stories tall. Swimming pools, tennis courts, gardens and roof terraces are also featured in the village".

The image above shows that the "vertical village" piles a lot of apartments onto a relatively small piece of land without being ugly. Maybe New York, San Francisco and other crowded cities can learn from Singapore.

But is the supply really limited? In New York City you can see a lot of new towers which multiply the number of available apartments per square foot (driveby). Going vertical seems to be the answer to the rising demand for the limited supply of land. But the new skyscrapers in Manhattan are build for a very wealthy clientel and therefore expensive too. There are cheaper solutions as you also can spot in New York City and many other cities. But these affordable tenement towers are often ugly and unpopular.

It seems that Singapore has the solution. A "vertical village" in city-state has been named the World Building of the Year (independent). "Judges at the eighth annual World Architecture Festival, held in Singapore, awarded the top prize to "The Interlace". The village, designed by the Office for Metropolitan Architecture and Buro Ole Scheeren was praised for its “radical and alternative” approach" (image above). "The building contains 31 ‘stacked’ residential blocks and is six stories tall. Swimming pools, tennis courts, gardens and roof terraces are also featured in the village".

The image above shows that the "vertical village" piles a lot of apartments onto a relatively small piece of land without being ugly. Maybe New York, San Francisco and other crowded cities can learn from Singapore.

Thursday, November 19, 2015

Contemporary Art: Masterpieces For Everyone?

(Drivebycuriosity) - Contemporary art has the reputation to be very expensive & exclusive, a luxury just for the one-percent. For instance the rock icon David Byrne claims that "the art world caters to the 1%. It’s obvious that the

outrageous prices for contemporary art mean that—although anyone can

look—only the very wealthy can afford it" (driveby).

My frequent visits at New York`s art galleries show me that this is not true. Last week´s auctions for contemporary art in Manhattan confirmed this. There were many art works available for a price below $30,000. Art works are luxury of course, but many pieces cost around the same or even less than a middle class car and are avaible for many people. Contemporary art could be used as high-end consumer goods (like SUVs, expensive furniture and such). Buyers could upgrade their homes, indulge themselves and impress friends, neighbors & family.

Below you can see a collection of affordable paintings sold at last week`s contemporary art fall auctions @ Sotheby`s, Christie´s & Phillips - as usual a very subjective selection.

Last week Phillips, the number three in the auction world (phillips), sold "Waiting Crowd" by Wayne Gonzales (2007, acrylic

on canvas) for $16,250. It had been estimated in the range of $8,000-12,000. The painting fascinates me by the technique.

From close I could just see black & white brush strokes, just from

some distance the picture - the crowd - got recognizable.

Below you can see more from the Phillips auction:

Paul Jenkins`s "Phenomena Spectrum Crossing" (1983, acrylic on canvas) was sold for $37,500 (estimate: $25,000-35,000);

David Levinthal`s "Untitled (From Barbie Series)" (2008, pigment print on canvas) was sold for $37,500 (estimate: $30,000-40,000).

"Six Red Barbras (Jewish Jackie Series)" by Deborah Kass, which reminds me of Warhol´s portraits, (1992, synthetic polymer and silkscreen ink on canvas) stayed unsold (estimate: $15,000-20,000).

"Old Street 6" by Slawomir Elsner (2007, oil on canvas) stayed also unsold (estimate $8,000-12,000).

Paulina Olowska`s, Romance Talking (2000, acrylic on canvas) (estimate $8,000-12,000) was sold for $7,500.

Enrico David`s "Untitled (2007, acrylic on canvas) (estimate $20,000-25,000) was sold for "$25,000.

"Now Wut" by Leo Gabin (2011, laquer, spray paint, acrylic and silkscreen on canvas) (estimate $15,000-20,000) was sold for $17,500.

"King Bee" (2001) by Charline von Heyl (estimate $15,000 - 20,000) was sold for $17,500.

Martin Eder`s "Untitled (698MEgirl05/05)" from 2005 (Estimate $3,000 - 5,000) was sold for $8,750.

Tom Wesselmann`s "Study for Smoker #27" from 1978 (Estimate $20,000 - 30,000) was sold for $23,750.

The much larger competitor Christie`s offered last week the powerful "Phenomena Onyx Ox Eye" by Paul Jenkins (1981, acrylic on canvas) for estimated $20,000-30,000.

White House In Silver

Sotheby´s, the other powerhouse in the auction world, also had some bargains last week (sothebys). They sold "Oscar Wilde" by Deter Dalwood (2003, oil on canvas) (estimate: $40,000-60,000) for $43,750. Below that you can see "Dui" by Christian Rosa which left the house for $30,000 (estimate: $15,000-20,000) followed by "World Traveler (Hotel Room)" by Inka Essenhigh (2004, oil on linen) (estimate $18,000-22,000). Unsold.

Sohteby´s also offered John Altoon`s "Untitled (F-8A) (1962-63, pastel and ink on illustration board) for $20,000-30,000 (above); unsold as well.

But they could see "Yellow House" by Alex Katz for $40,000 plus Petra Cortright´s "Metal Canopy Bed" for the same price (both below:)

Jonathan Meese´s "Hagen von Trontje´s Privatarmee" (below) was sold for $30,000 (estimate: $20,000-30,000).

And someone got @ Sotheby`s Wayne Gonzale´s "Untitled (White House - Silver) for just $8,750 (estimate: $10,000-$12,000)

It seems there was something for every taste and for (almost) every budget. Masterpieces for everyone.

My frequent visits at New York`s art galleries show me that this is not true. Last week´s auctions for contemporary art in Manhattan confirmed this. There were many art works available for a price below $30,000. Art works are luxury of course, but many pieces cost around the same or even less than a middle class car and are avaible for many people. Contemporary art could be used as high-end consumer goods (like SUVs, expensive furniture and such). Buyers could upgrade their homes, indulge themselves and impress friends, neighbors & family.

Below you can see a collection of affordable paintings sold at last week`s contemporary art fall auctions @ Sotheby`s, Christie´s & Phillips - as usual a very subjective selection.

Below you can see more from the Phillips auction:

Paul Jenkins`s "Phenomena Spectrum Crossing" (1983, acrylic on canvas) was sold for $37,500 (estimate: $25,000-35,000);

David Levinthal`s "Untitled (From Barbie Series)" (2008, pigment print on canvas) was sold for $37,500 (estimate: $30,000-40,000).

"Six Red Barbras (Jewish Jackie Series)" by Deborah Kass, which reminds me of Warhol´s portraits, (1992, synthetic polymer and silkscreen ink on canvas) stayed unsold (estimate: $15,000-20,000).

"Old Street 6" by Slawomir Elsner (2007, oil on canvas) stayed also unsold (estimate $8,000-12,000).

Paulina Olowska`s, Romance Talking (2000, acrylic on canvas) (estimate $8,000-12,000) was sold for $7,500.

Enrico David`s "Untitled (2007, acrylic on canvas) (estimate $20,000-25,000) was sold for "$25,000.

"Now Wut" by Leo Gabin (2011, laquer, spray paint, acrylic and silkscreen on canvas) (estimate $15,000-20,000) was sold for $17,500.

"King Bee" (2001) by Charline von Heyl (estimate $15,000 - 20,000) was sold for $17,500.

Martin Eder`s "Untitled (698MEgirl05/05)" from 2005 (Estimate $3,000 - 5,000) was sold for $8,750.

Tom Wesselmann`s "Study for Smoker #27" from 1978 (Estimate $20,000 - 30,000) was sold for $23,750.

The much larger competitor Christie`s offered last week the powerful "Phenomena Onyx Ox Eye" by Paul Jenkins (1981, acrylic on canvas) for estimated $20,000-30,000.

White House In Silver

Sotheby´s, the other powerhouse in the auction world, also had some bargains last week (sothebys). They sold "Oscar Wilde" by Deter Dalwood (2003, oil on canvas) (estimate: $40,000-60,000) for $43,750. Below that you can see "Dui" by Christian Rosa which left the house for $30,000 (estimate: $15,000-20,000) followed by "World Traveler (Hotel Room)" by Inka Essenhigh (2004, oil on linen) (estimate $18,000-22,000). Unsold.

Sohteby´s also offered John Altoon`s "Untitled (F-8A) (1962-63, pastel and ink on illustration board) for $20,000-30,000 (above); unsold as well.

But they could see "Yellow House" by Alex Katz for $40,000 plus Petra Cortright´s "Metal Canopy Bed" for the same price (both below:)

Jonathan Meese´s "Hagen von Trontje´s Privatarmee" (below) was sold for $30,000 (estimate: $20,000-30,000).

And someone got @ Sotheby`s Wayne Gonzale´s "Untitled (White House - Silver) for just $8,750 (estimate: $10,000-$12,000)

It seems there was something for every taste and for (almost) every budget. Masterpieces for everyone.

Subscribe to:

Posts (Atom)