(Drivebycuriosity) - There is a lot ado about the falling commodity prices. Many pundits claim that collapsing prices for oil, copper, aluminum and other materials are spelling doom. For instance Bloomberg columnist Liam Denning writes:"Commodities are sounding alarm" (bloomberg). Blog author Jeff Miller asks: "What is the message from falling commodity prices?" (seekingalpha). They and other experts suggest that cheaper commodities are signaling a worsening of the global economy.

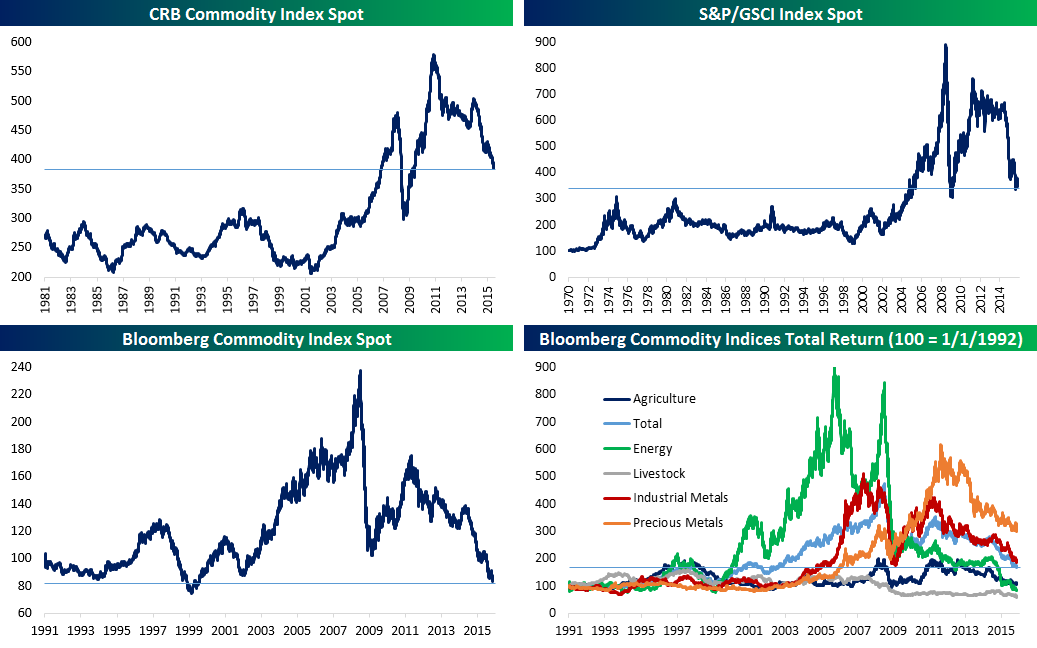

But the charts below - indices for commodity prices supplied by Bloomberg and others (bespoke) - show that commodity prices just fall back to the level they had before the year 2004. So, the commodity prices just went back to their long term averages - back to normal.

The alarmists don´t show you these charts of course. They want to scare you. They show you a much shorter time period to manipulate you. The screenshot below is taken from the quoted Bloomberg article.

If the alarmist would be right and commodity prices would be indicators for the global economy, than the 1990s (low commodity prices) would have been a period of stagnation and the period from 2004 through 2014 (high commodity prices) would have been a global boom. The reality was quite contrary - cheap commodities went along with an economic boom from 1985 through 2000. And the high commodity prices in the recent years were accompanied by a sluggish economy.

It seems that we are back on the long term (secular) trend of falling commodity prices: "There has been a downward

trend in real commodity prices of about 1 percent per year from

1862-1999 (commodity prices fell 1 per cent p.a. relative to the general price level) (jstor) .

The long term trend (of falling commodity prices) had been interrupted from around 2004 through 2014 thanks to the financialization of the commodity sector. Around 2004 commodities became fashionable. Banks and brokers, who earn a lot money from commodity speculation, claimed that the world will soon run out of oil and other materials and created so a hype. Hundreds of hedge funds, specialized commodity funds and others invested

into the commodity sector in the hope of further rising prices. They

bought directly - or indirectly via ETFs & bank certificates -

financial contracts (futures) which are backed by commodities

(financialization). So oil and other commodities became assets which are

traded on financial markets like stocks, currencies and bonds. During the financialization process many billion got pumped into oil and other materials which led to abnormal high prices (bubbles). As a consequence commodity producers produced more and consumers less - and finally the bubbles started to pop. I agree with

scientists who claim that "the dramatic price increases over the last

decade were just a temporary blip up within the context of a longer-run

trend of stable or declining relative prices"(econbrowser).

The secular trend of falling commodity prices is based on human nature

and factors like ingenuity, frugality and profit

orientation. In fact, people have been responding to scarcity and rising

commodity prices all the time. Generally higher prices have been

animating

producers to produce more because they get higher profits. On the other

side, consumers have been switching to cheaper alternatives and have

been developing methods to deal with rare resources for thousands of

years.

The shale oil revolution in the US is just one example for why

commodities get cheaper

over the time. Technological progress and human ingenuity are reducing

the cost of oil exploration and are enabling investors to tap reserves

which have been to costly before. Farmers use more and more machines for

planting & harvesting and benefit from improvements in irrigation,

fertilizer, pesticides, and hybridization. Technological progress leads

to advanced seed and fertilizer products, along with more efficient

agricultural equipment

liker tractors, loaders, harvesters. All are enhancing the

productivity of farming. And miners also use better

machines and new technologies to prospect metals & coal.

On the other hand, technological innovations leads to a demand

destruction: Cars are becoming more and more energy

efficient; modern refrigerators, washing machines, air conditioners and

many other household appliances use less electricity than older models.

Consumers & companies also are using metals and other commodities

more economically.

I think it is highly likely that we will experience another prosperous

period like the epoch 1985 through 2000. Oil and other commodities

should stay cheap (oil price way below the $100 plus of the recent

years) thanks to the technological progress which is reducing the costs

of oil exploration significantly, amplifying oil production (economics21).

Advances in technology are reducing the costs for farming and mining as

well. The demand for commodities should be restrained because cars and

other machine are getting more energy efficient. The rising use of

solar- and wind energy should also put a dent into the demand for oil.

I think that the combination of cheap commodities

and technological progress will fuel company profits and inspire

consumer spending as they did in the boom from 1985 through 2000.

Welcome back normality.

P.S. For ilustration I used the painting “Miner Pushing Ore Cart” by William D. White.

No comments:

Post a Comment