Monday, July 25, 2016

Movies: Cafe' Society

Thursday, July 21, 2016

Stock Market: Return To Normality

Tuesday, July 12, 2016

Contemporary Art: What`s New On Chrystie Street , New York

(Drivebycuriosity) - New York´s Lower East Side district is a magnet for connoisseurs of contemporary art. There are about 1305 art galleries. Two of the best are on Chrystie Street, where you can frequently see interesting shows.

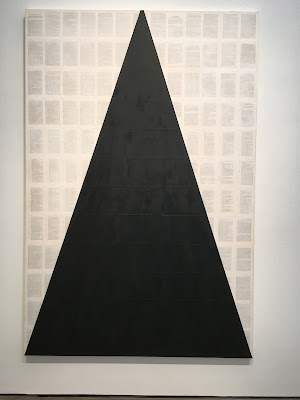

Lehmann Maupin ( 201 Chrystie Street lehmann ) has now an exhibition with work by Kader Attia, Tim Rollins and K.O.S., and Mickalene Thomas. The show is called "Repossession" (through August 12, 2016). The press release explains: "Each of these artists has devoted their practice to confronting predominant historical narratives embedded in Western culture. Using the language of collage, the artists mine historical and cultural ephemera to create alternative histories that reveal omissions and inaccuracies and celebrate the voices of those who are often invisible or overlooked".

Above you can see my favorites from the show, as usual a very subjective selection.

The neighbor CRG Gallery (195 Chrystie Street crggallery) has also an interesting group exhibition with paintings by Steven Bindernagel, Tomory Dodge, Pia Fries, Sam Reveles, Steve Roden (through August 5, 2016). Below some impressions:

Enjoy!

Monday, July 11, 2016

Stock Market: A New All Time High - What Now?

All-time highs are normal and part of the nature of stock markets. In the long run stock prices HAVE to go up because the global economy is growing - there is no limit. According to a study of the University of New York the US stock market (S&P 500) created an average return of about 10% p.a since 1928! (dividends reinvested nyu.edu/ investopedia). History also shows that in the long run the stock market, represented by the S&P 500, is gaining around 7% annually on average - without counting dividends (ritholtz ritholtz). On the average every day is in the green, though just marginally. Dips, corrections & crashes are anomalies and just aberrations from the long term upwardly trend.

I believe that the bull market for stocks will continue for years. Inflation & interest rates are still very low (even that the Fed will continue hiking her interest rates this year). Companies are reducing costs & debts, getting more efficient & productive. Last Friday we learned that the US job market is still expanding with a moderate pace and wages continue to grow. The growth of personal incomes in the US will continue to fuel a rising consumer demand which will also generate rising company profits.

The global economy is still getting a lot of tailwinds from cheap commodities. Last year`s price collapse for oil, industrial metals and some agricultures works like a gigantic tax cut. Companies have lower costs, meaning more money to invest (including into a rising labor force), and consumers have more money in their wallets. More jobs, faster rising wages and cheap gasoline should speed up consumer spending in the US which will foster the global economy (US imports = rising European & Asian exports).

Companies also are benefitting from the technological progress - evolution of Internet and other software (including AIs), robotics, 3D-printing and more - and are getting more efficient which will translate into rising earnings. The technological progress is fostering globalization as well. Emerging countries like China and India have easier access to new technologies which is promoting their transformation into modern economies. These processes are working together, creating global economic growth in the decades to come.

Sunday, July 10, 2016

Brexit: Will London Be Replaced As A Global Financial Center?

I don´t think so. There are no alternatives which could replace London.

Take for instance, Frankfurt, the seat of the European Central Bank and Germany`s financial center. The town is way too small & too provincial. The place has just a population of about 700,000 and lacks the infrastructure needed to attract (London has more than 8 million).

Paris is certainly comparable with London by by size & glamour. But the city is the capital of a country, which is very bureaucratic, over-regulated & xenophobe (ask the French what they think about the English, the Americans and the Germans, look how the government treads foreign big companies). France´s governments are usually anti-corporation and anti-foreign banks.

New York won`t replace London either. The global finance business will still need an alternative to Wall Street & New York and doesn´t want to be too influenced by the US policy & Washington DC. Banks still need the competition between New York, London and the far east places (Tokyo, Singopore, Shanghai, Hong Kong).

I believe that London will even get more attractive as a financial center when the UK - and her capital - aren`t anymore controlled by Brussels. I think London will become more liberal and less regulated. The British government already announced tax cuts for corporations

Even the management of HSBC, a bank which was founded in Hong Kong with most of the business in overseas, declared to want to stay in London ( ft.com).

London will continue to prosper, maybe even better than before.

Contemporary Art: What`s New @ Gallery Artifact, New York?

Here are my favorites from the current exhibition, as usual a very subjective selection. Above 2 paintings by Harold Naideau, below you can see abstracts by Ioana Niculescu-Aron.

Enjoy!

Saturday, July 9, 2016

Science Fiction: Deep Navigation By Alistair Reynolds

(Drivebycuriosity) - Alistair Reynolds is one of the brightest stars on the firmament of contemporary science fiction. The British author, who has a PhD in physics, started his career as research astronomer for the European Space Research and Technology Centre (part of the European Space Agency) until 2004 when he left to pursue writing full-time ( wikipedia). Since then he spezializes in hard science fiction and space opera. The short story collection "Deep Navigation" shows his mastership ( amazon ).

The 15 stories are pure hard science fiction - they all are based on science. Reynolds shows the skill to transform a scientific concept into a thrilling plot. One story is a based on the laws of thermodynamics which leads to dramatical results (I don´t say which, this is a spoiler free blog), another story is build on quantum physics. One story involves evolution, especially how some alien spezies adapted to extreme & exotic environments. Some stories deal with the hypothesis of a multiverse, a hypothetical set of finite and infinite possible universes, including the universe in which we live ( wikipedia) or play with the idea of a singularity, when intelligent machines have overtaken the earth.

I enjoyed reading all 15 stories. 3 of them are my favorites:

"The Fixation" is set in an alternate world, a very modern Persia. Museum agents are restoring a very ancient machine. Someone has a fascinating idea how to refurbish the device.

"Monkey Suit" is about an engineer who is repairing the

hull of a huge spaceship in outer space - a very tedious, dangerous

& responsible task. Reminds me of Stanislaw Lem`s space pilot Pirx stories, but much more advanced.

"Byrd Land Six" is a thriller set in a scientific base on Antartica.

There are more remarkable stories:

"Stroboscopic": A professional player participates in a dangerous game with alien arthropods.

"The Fury": The bodyguard of the galactic emperor investigates his boss` assassination

"The Star Surgeon`s Apprentice" is an adventure story set on a space ship.

Reading Alistair Reynolds is highly recommended for all lovers of real (hard) science fiction and this short story collection is a good entry point.

Tuesday, July 5, 2016

Contemporary Art: A Pledge For Equal Rights @ White Box, New York

I don`t know if the artist will be heared. But I find the show entertaining at least. Here some impressions from the show.

Enjoy!

Sunday, July 3, 2016

Stock Markets: Brexit? What Brexit?

Above you can see the chart the FTSE 100, the gauge for the British stock market in London. After a sharp & hysterical response in the early minutes of Friday 24th, the day after the vote, the index more than recovered. "The FTSE 100 has recorded its best weekly performance since December 2011", reports the Guardian ( theguardian ).

Wall Street shrugged as well. Above the chart of the SP 500, the gauge of the US stock market. The SP 500 had the best week in this year so far ( bloomberg. ).

The stock markets show that the hysteria in the media is unjustified. The British economy will be better off when they leave the European Union (EU). Brussel has been gaining more and more power over the years - developing the EU Union into something like the defunct Soviet Union, a bundle of states ruled by a central government. The European Parliament and the EU committee, especially Jean-Claude Juncker, the President of the European Commission, treat the EU increasingly like a kingdom. Even after the Brexit decision they want to expand the power of the EU and demand more integration, meaning more power for Brussels ( spiegel.de).

UK will benefit from the exit because it will be less regulated. A liberal (less regulated) England could attract companies and investors from all over the world. The economy blogger Scott Grannis writes "one of the very good things that could come of a Brexit: shaking off the Eurosklerosis that has held back growth in the Eurozone for many years" ( scottgrannis ).

Small countries can prosper even when they are not part of a big union: Switzerland and Norway aren`t member of the European Community - and both countries are doing well. People worldwide are buying Swiss products & services and don´t care whether the country is part of an union or not. If you need more examples for small independent countries who are prospering, you might take a look on the history of Singapore & Hong Kong. It is highly unlikely that the rest of the world will curb trade with England and invest less there if the country is on her own. Companies are doing business with the island because they are making profits there. Why should they give up these profits?

London will stay one of the leading global financial centers. Frankfurt is not an alternative because the town is too small & too provincial. Paris is the capital of a bureaucratic, over-regulated & xenophobe country with an anti-corporation tradition (ask the French what they think about the English, the Americans and the Germans, look how the government treads foreign big companies). The global finance business will still need an alternative to Wall Street & New York and doesn´t want to be too influenced by the US policy & Washington DC. London could even be a winner when the financial center is not anymore controlled by Brussels. Even the management of HSBC, a bank which was founded in Hong Kong with most of the business in overseas, declared to want to stay in London ( ft.com).

UK will continue to prosper, maybe better than before.