(Drivebycuriosity) - There is a lot ado about the tumbling oil prices. But - as the charts below show - the price of oil is just going back to the levels before 2004. I think that we are experiencing the return of normality.

Below you can see the price of WTI - the US type of oil- since 1990 and the US gasoline price, which usually trails the oil prices.

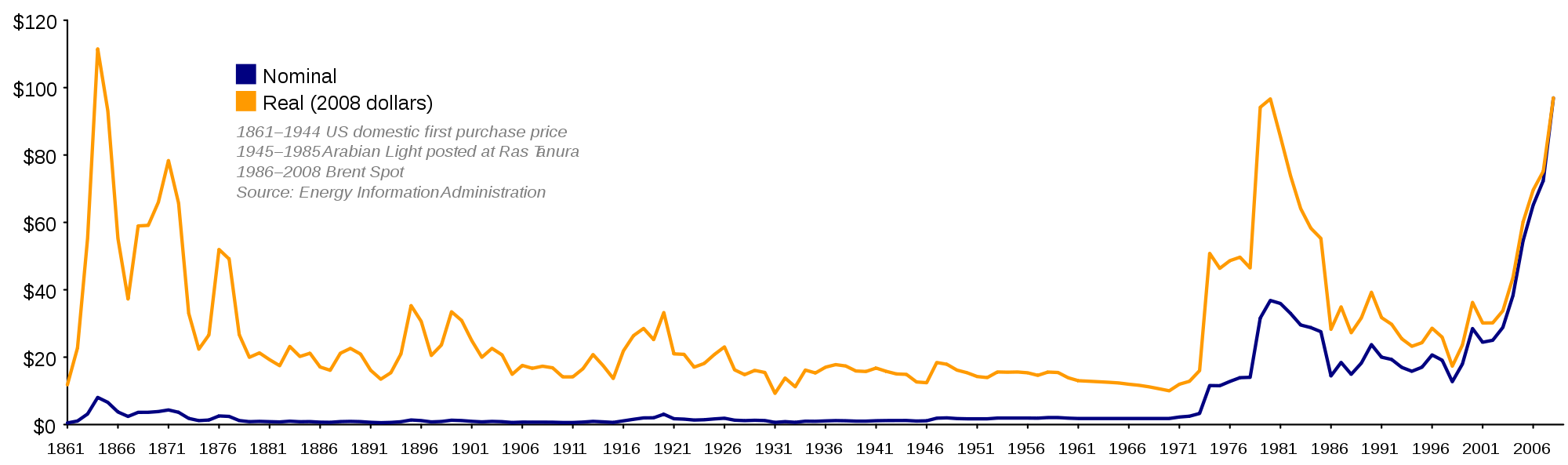

According to Morgan Stanley the long term average price of oil - inflation-adjusted over 100 years - floated around $50 (bloomberg). The chart below shows how oil prices fluctuated from 1861 through 2006 (wordpress).

From 1970 through around 1980 the oil price jumped because OPEC cut production to punish the West for Israel`s Yom Kippur war.

In the period 2004 through 2014 oil prices hovered again on a very elevated level - with the short exception of the 2008 recession - which wasn´t sustainable. The excessive high oil prices of the recent years (bubble) had 2 causes:

1. Geopolitical fear mongering: Since the year 2004 oil prices have been agitated by continuous speculation on conflicts in the Middle East, the so-called Middle East tensions, and the Ukraine conflict. Wars and unrest in Iraq, Libya, Syria, Egypt and other countries of this fragile region plus the ongoing conflict with the Iran about its nuclear facilities all induced speculation that the global oil supply could be endangered. Hence the price of oil had a high geopolitical risk premium.

2. Massive speculation in commodities (financialization): Around 2004 oil and other commodities became fashionable. Banks and brokers, who earn a lot money from commodity speculation, claimed that the world will soon run out of oil (peak oil) and created so a hype. Hundreds of hedge funds, specialized commodity funds and others invested into oil in the hope of further rising prices. They bought directly - or indirectly via ETFs & bank certificates - financial contracts (futures) which are backed by oil. So brent crude (international type of oil) and wti (US type of oil) became assets which are traded on financial markets like stocks, currencies and bonds. During the financialization process many billion dollars got pumped into oil which inflated oil prices substantially (oil bubble).

The oil bubble of 2004-2014 caused a massive over supply. Non of the alleged massive supply disruptions happened and the elevated prices strongly animated production & dampened demand.

The oil price might fall temporarily sharply below the long term average to get rid of the oversupply (to clear the market). When the market is balanced again the oil price should continue to float around the historical average of $50 (maybe in the range of $30-$60). The technological progress leads to falling production costs and induces new producers (like US frackers) to pump more oil if prices climb again. The geopolitical situation is still critical but less tense than in the past years and the financial speculation is somewhat discouraged thanks to the commodity bubble implosions which caused them high losses.

Welcome normality.

No comments:

Post a Comment