(Drivebycuriosity) - Recently there was a lot talk about a new Quantitative Easing and negative interest rates. But the facts from the economic frontier suggest that the Federal Reserve has to stay on course and has to continue the interest rate hikes this year.

1. The US inflation is accelerating. The core inflation rate climbed onto 2.2% annually (chart below).

It is highly likely that the tightening labor market will drive wages

and therefore labor costs upwards which should translate into higher

prices for services and labor intensive goods (like fashion). And we are already

experiencing rapidly climbing rents and health care costs.

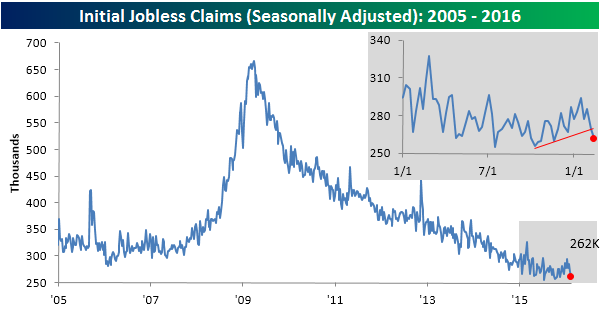

2. The US job market is getting tighter. In January unemployment rate dropped to 4.9%, average hourly wages climbed 2.5% compared to last year and the weekly jobless claims are on a downtrend and close to a 40 years low. A tighter job market will cause further climbing wages and translate into higher prices for services and labor-intensive goods.

The headline inflation rate (plus 1.4%) is momentary depressed because

of the collapse of oil and other commodity prices. Today oil is around

40% cheaper than last year the same time and gasoline prices at the pump

dropped about 25%. But the diminishing price effect of dramatical

reduced energy prices is just temporary. Prices for oil and other commodities already started rising in the recent days. There is a risk that general

inflation will climb next year more than 2% - and could accelerate -

when the diminishing effect of cheaper commodities will run out.

3. The general US economy is sound. Retail sales (ex gasoline) are growing 4.5% year-over-year - and accelerating and industrial production is climbing too.

Abnormal low interest rates were necessary in the years after the recession to encourage investors & consumers. They don´t fit to a growing economy where inflation is already accelerating. I think that the Fed has to hike in April and then again in later quarters.

No comments:

Post a Comment