(Drivebycuriosity) - Jerome Powell is in the headlines these days. The Chairman of the Federal Reserve tries to fight inflation. But Powell declared in public that he understands little about inflation ( image above source).

Powell neglects - maybe he doesn`t understand - that the high inflation of the recent years was caused by a deluge of money. In his 2023 Jackson Hole speech he stated: "The ongoing episode of high inflation initially emerged from a collision between very strong demand and pandemic-constrained supply" ( federalreserve). He added: "it was clear that bringing down inflation would depend on both the unwinding of the unprecedented pandemic-related demand and supply distortions and on our tightening of monetary policy, which would slow the growth of aggregate demand, allowing supply time to catch up". Powell talks a lot about "aggregate demand", whatever that means, there is no mentioning of "money".

And in 2024 Powell declared: "High rates of inflation were a global phenomenon, reflecting common experiences: rapid increases in the demand for goods, strained supply chains, tight labor markets, and sharp hikes in commodity prices" ( federalreserve). What about money? Apparently the leader of the American monetary authority does not care about money.

The Deluge

Powell ignores that in 2020 & 2021 the Biden government flooded the economy with stimulus checks in the value of trillions of dollars to fight the Covid19 recession (American Rescue Plan). The government checks got financed with massive bond purchases by the Federal Reserve (Quantitative Easing known as QE1,QE2 & QE3).

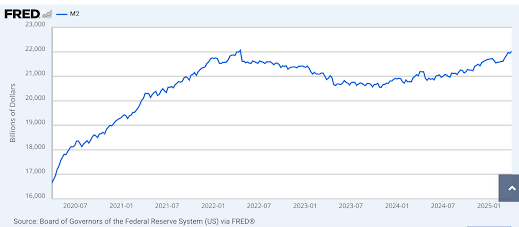

The government money landed directly on the bank accounts of the Americans, blowing up the money volume M2 (bank notes & coins & deposits at banks). Milton Friedman described this as helicopter money (cato ). As a result in 2021 & 2022 the US money supply M2, the engine of the inflation, jumped 40%. So the price level inevitably had to jump also and the inflation rate (first derivation) went up.

Causal Relationship

The causal

relationship between the money supply and inflation was already

recognized by Nicolaus Copernicus! The astronomer explained in the year 1517 why "too much money"

causes inflation. Copernicus` "quantity theory of money" is based on

observations: Early in the 16th century Spain conquered today`s Latin America and

looted the silver stocks. The Spaniards send the precious metal to Europe where it was printed into coins and used as money.

As a result the European money supply jumped, but the supply of goods & services did not change much. The flood of money raised suddenly the demand for scarce goods & services and caused a jump of the price level.

Elaborated studies by Milton Friedman, Karl Brunner, Allan Meltzer and many other economists (known as Monetarists) confirmed Copernicus & their quantity theory of money. They described in the 1960s elaborately how and why the inflation rate follows the growth rate of money with a time lag (causal connection).

( source)

The recent monetary deluge ended 2 years ago. After a temporary decline, the money supply started to grow again, but modestly. In March the US money supply advanced just about 4% y-o-y (below the long term growth trend of 6% scottgrannis) and the inflation rate is falling and approaching the unofficial Fed target of 2%. But I could not find the word "money" in any of Powell´s speeches and statements.

It turns out that Powell is economic illiterate and ignorant of history. The US monetary authority deserves a better Chairman.

No comments:

Post a Comment