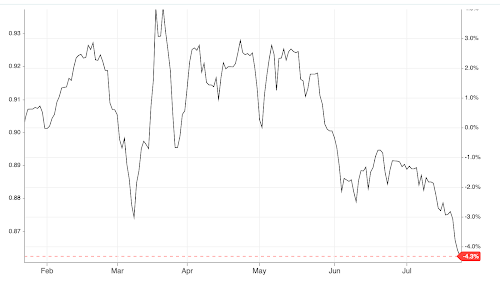

(Drivebycuriosity) - The US dollar seems to be in a free fall. The US currency is under pressure since early May. Inversely the Euro climbed from $1.08 to $1.16 (charts below). There are at least three reasons for the dollar weakness:

1. In the US the COVID-19 pandemic is still spreading. Steeply rising numbers of new reported cases & hospitalizations are slowing the reopening of the economy and are forcing some states & counties to implement new lockdowns. Some consumers are too scared to shop and many businesses are closed because of the infection risk. Contrary to the US most European countries, including Germany, got the pandemic mostly under control (charts below). Therefore the European economies are recovering earlier than the American which is apparently lifting the Euro.

2. President Trump and Secretary of State Mike Pompeo restarted the trade war against China. This week they closed China`s consulate in Houston. The conflict has been hurting the US economy already for years because the trade war reduces US exports, cuts US companies from global supply chains, reduces the supply of cheap consumer goods and dampens the American business & investment sentiment. An escalating trade war would weaken the already ailing US economy further.

3. The currency markets might also respond to the noise from the upcoming November election in the US. Joe Biden, the candidate of the Democratic Party, is leading the polls. The liberal politician stands for more taxes & more regulation and could harm the already weak business & investment sentiment in the US. The dollar might also suffer from the riots around the Black-Lives-Matter movement which is combined with an rising anti-business and anti-capitalism sentiment in the US.

No comments:

Post a Comment