(Drivebycuriosity) - The financial markets and the Federal Reserve are obsessed with the US inflation rate. The monetary authority and many pundits seem to believe that inflation will stay stubbornly high and will need more interest rate hikes by the Fed.

But these views are not covered by the facts. The money volume, the engine of inflation, is shrinking! The aggregate M2, the gauge for US money volume, dropped in March 4.05% YoY (image above ycharts ).

(source )

The high inflation rate was caused by a flood of money in the past. In 2020 & 2021 the US government flooded the economy with stimulus checks in the value of trillions of dollars (American Rescue Plan), supported by huge bond purchases by the Federal Reserve .

The government money landed directly on the bank accounts of the Americans, blowing up the money volume M2 (bank notes & coins & deposits at banks).

Over two years the US money volume M2 jumped about 40% as a result (the charts above display a huge hunchback fred.stlouisfed). The money deluge met a constraint supply of goods & services, partly because of Covid19. It is no surprise that prices had to increase so much (marginalrevolution).

But monetary growth peaked already in February 2021 (with plus 27%). Since then the monetary growth rates have been falling and turned negative in December 2022. In the recent months the money supply was shrinking! "We have never seen money taken out of the economy like this in our history" ( twitter.com).

The causal connection between money and inflation is known since the 16th century at least. Nicolaus

Copernicus described already in the year 1522 how "too much money"

causes inflation. Copernicus` "quantity theory of money" is based on

observations:

The Spaniards had conquered today`s Latin America and looted the silver stocks. They send the precious metal to Europe where is was used as money. As a result the European money volume jumped, meeting a restrained supply of goods (agriculture, hand works) & services. The flood of money raised suddenly the demand for scarce goods & services and caused a jump of the price level.

Elaborated studies by Milton Friedman, Karl Brunner, Allan Meltzer and many other economists (known as Monetarists) described already in the 1960s how and why the inflation rate follows the growth rate of money with a time lag (causal connection).

( source)

( source)

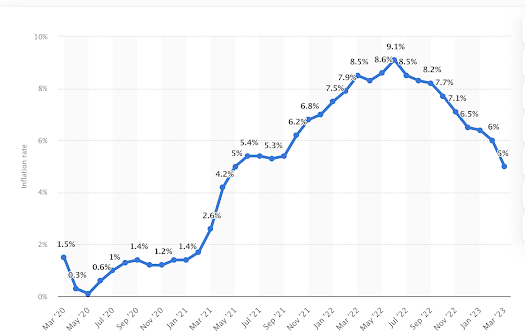

The inflation rate followed the monetary growth rate with a lag of 16 months and peaked in June 2022 with 9.1%. Since then the inflation rate dropped to 5%, a minus of about 4 percentage points.

I expect that inflation will continue to follow M2 and drop significantly in the coming months. Before end of the year the inflation rate could drop to 2%, the inflation target of the Federal Reserve.

Welcome to disinflation.

No comments:

Post a Comment