(Drivebycuriosity) - The begin of a new year is the time to look back and ahead as well. Last year the US stock market went nowhere. The S&P 500, the gauge for the US stock market, gave up 0.7%, if you reinvested the dividends (total return) you made a tiny plus (+1.25% seekingalpha). Yawn.

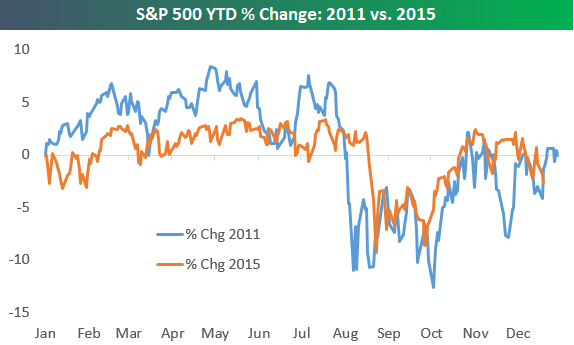

Last year´s stock market performance was almost identical to 2011 (chart below bespokepremium). In both years the stock market took a breather after a sharp rally in the year before, the usual consolidation phase. 2015 had headwinds by the expectation of an interest rate hike (that finally arrived in December), Europe`s woes, ongoing speculation about China´s growth and dropping oil prices that spoiled the sentiment.

I think there is a high probability that the rally will restart in 2016 and we will enjoy another year of the bull. I suppose that company profits will surprise positively and will rekindle the stock market again. The pessimistic majority underestimates how efficiency gains and technological progress enable companies to create rising earnings even in a sluggish economy. Don´t believe the headlines that "the profits" of the US companies are falling in general. The picture is blurred by the energy sector that has to deal with dropping oil prices. The rest of economy is doing well.

I suppose that the global economy (macro environment) is getting stronger. The US job market is generating monthly about 200,000 new jobs and climbing wages. Both should translate into rising consumer spending, the engine of the economy. Cheaper oil and other commodities are creating a lot of tailwinds, because consumers have more money to spend and companies have less costs. It seems that China´s economy is managing the planned transformation process thanks to accelerating retail sales and a faster growing service sector (driveby). The country could resume as the growth engine of the global economy. I expect some headwinds from the Fed which could hike interest rates again step by step - but the interest rates raise should be mildly because inflation will by tamed by cheap commodities.

The majority of the fund manager is still skeptical and many are sitting on huge cash reserves or are even betting against the stock market (short selling). They might respond to better economic news and could come back. History says the "stocks rarely deliver two straight years of flat returns. Instead, flat years are usually followed by double-digit years" (businessinsider). So, with some luck the S&P 500 could cross the mark 2,300 by end of 2016. Happy New Year.

No comments:

Post a Comment