(Drivebycuriosity) - This week the financial markets got spooked again by hawkish comments by the Federal Reserve. Fed Chair Powell declared on Tuesday that interest rates are "likely to be higher’ than previously anticipated" ( cnbc ). The leader of America`s central bank added: "“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated”.

I beg to differ.

The current high inflation rates are caused by too much monetary growth in the past. In 2020 & 2021 the

US government flooded the economy with stimulus checks in the value of

trillions of

dollars (American Rescue Plan), supported by huge bond purchases by the

Federal Reserve. The government money landed directly on the bank

accounts of the Americans, blowing up the money volume M2 (bank notes

& coins & deposits at banks).

( source)

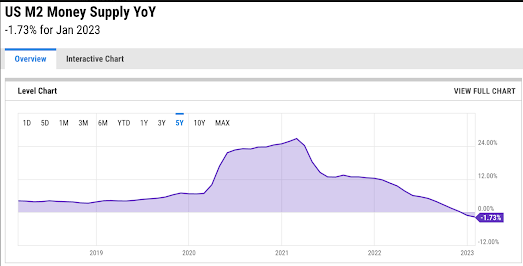

Over two years the US money volume M2 jumped about 40% as a result. The money deluge met a constraint supply of goods & services, partly because of Covid 19. It is no surprise that prices increased so much (marginalrevolution).

Causal Connection

The causal connection between money and inflation is known since the 16th century at least. Nicolaus Copernicus described already in the year 1522 how "too much money" causes inflation. His "quantity theory of money" is based on observation. The Spaniards had conquered today`s Latin America and looted the silver stocks. They send the precious metal to Europe where is was used as money. As a result the European money volume jumped, meeting a restrained supply of goods (agriculture, hand works) & services. The flood of money raised suddenly the demand for scarce goods & services and caused a rise of the price level.

Milton Friedman, Karl Brunner, Allan Meltzer and other economists described already in the 1960s the complex connection between money and inflation.

( source)

( source)

(source )

The good news is: Monetary growth has already peaked - in February 2021 (plus 27%). Since then the monetary growth rates are falling and turned negative in December 2022 (images above). In the recent months the money supply was shrinking! "We have never seen money taken out of the economy like this in our history" ( twitter.com).

(source )

Inflation is following with a lag of about a year and peaked in June 2022. The shrinking money volume will curb inflation further (scottgrannis ). There is no need need for further interest rate hikes.

It seems that Powell and his colleagues from the Fed are economic illiterate.

No comments:

Post a Comment