Friday, May 30, 2014

Stock Market: The Real Hedge Funds Scandal

Do their customers, those who invest into hedge funds, earn stellar results? Nope. "Over the past 10 years, even a conservative portfolio that invested just 60% in the US stock market (S&P 500) and kept 40% in bonds still outperformed the average hedge fund", discloses "MarketWatch" (marketwatch). So, even Joe Sixpack who puts some money into S&P 500 ETFs can do better.

"Why do they make so much?" asks "The New Yorker" (newyorker) and adds: "It’s a competitive industry, and there’s no obvious reason why the normal laws of economics shouldn’t apply," meaning that their fees should follow their meager results.

The "New Yorker" and other commentators explain the extreme high fees partly with the fact that hedge funds don`t cater Joe Sixpack. By law only certain types of investors are allowed to put their money into a hedge fund -- very rich people (the one percent) and large institutional investors, such as pension funds, charitable endowments, and even government investment funds.

I don`t care what billionaires do with their own money, but it is a real scandal that pension funds and charitable endowments, thus institutions which administer the money of other people, spend billions of dollars for hedge funds fees. Why do these institutional investors burn tons of other peoples money, for instance the pensions of their clients, for an industry which performs on average worse than Joe Sixpack? Why does for instance California´s "CalPERS", a huge public employees' retirement system, pay more than $1 billion fees for "external management fees" (twitter). This money is of course not any more available for the pensions of their clients.

"Institutional Investor" author Ashby Monk (institutionalinvestor) complains that pension fund managers, the largest group of hedge fund investors, are too generous with other people`s money (economists know this as the principal-agent-problem). Monk calls this problem a "governance deficiency", in plain English, these pension funds and other public institutions are bad managed and their manager don´t do the best for their clients, the people who`s money they administer. The boards of the pension funds, those who control these huge institutions, "need to recognize that paying $1 billion in external fees per year is completely outrageous. But many don`t", critizes Monk.

Why do billionaires and public servants waste their own and other peoples money to finance a crowd of hedge fund billionaires? The answer is - I believe - the huge reputation of hedge funds. Many people, including billionaires and curators of pension funds, seem to believe that hedge fund managers are gods and can walk over water. Tadas Viskanta, owner of the blog "Abnormal Returns" reports, that at the Skybridge Alternatives Conference - a gathering of hedge fund managers and their groupies -, "host Anthony Scaramucci told attendees that “Mutual funds are the propeller planes…while hedge funds are the fighter jets.”(money).

Blind Trust

And in indeed, hedge funds are hyped in the media and treated like rock stars. Journalists are gluing at their lips and are quoting any comment of a hedge fund manager as it would be the epiphany of a messiah. Hedge funds are usually called "smart money" , even that they on average perform worse than Joe Sixpack and usually sell when everybody is selling and buy back when everybody is buying (herding behavior).

This cult around hedge funds reminds me of the Bernard Madoff investment scandal (wikipedia). The Wall Street rogue financier offered modest but steady returns to an exclusive clientele, reports Wikipedia. The fraudster claimed that he - with the use of futures and options - could cushion the returns of the invested money against the market's ups and downs, exactly what hedge funds also claim. Madoff`s clients included banks, hedge funds, charities, universities, and wealthy individuals, including Steven Spielberg, actors Kevin Bacon, Kyra Sedgwick, John Malkovich, and Zsa Zsa Gabor.

Madoff`s customers became victim of their blind trust in celebrities. Anyway, what these super rich people did with there own money is not my business. But it is a scandal that institutional investors like banks, charities and universities handed the money of their clients over to someone they don´t control. Hedge funds may be legal (even that some managers got caught with insider trading), but when administrators of public funds pay hedge funds billions of dollars fees out of the pockets of their customers - this is another scandal!

Contemporary Art: POLISH @ Rox Gallery, New York City (NSFW)

(Drivebycuriosity) - New York´s Lower East Side (LES) is not only a place to party, the area also has a blossoming gallery scene. LES still stands for a bit rough, wild and nonorthodox. Gallerists often migrate there from other parts of the City, where they show works of established artists, to exhibit emerging artists.

One of the most interesting places is the Rox Gallery @ 86 Delancey Street (roxnyc). They claim to be "known for pushing the limits of the standard gallery model with a multi-platform approach". These days you can see there an exhibition called "POLISH" (through Jun 26 2014).

According to their flyer (which you can get there) they feature the works of over fifty artists. On 2 levels you can see paintings, collages, sculptures, photographies and light installations. As usual - some artists like to provoke and aren´t afraid to show nudity.

Here are my favorites from the show. Let the pictures speak for themselves. Enjoy.

Wednesday, May 28, 2014

Culture: Street Art - What`s Going On In Lower Manhattan - May 2014 Edition

Since my latest street art report from April 2014 (driveby) I discovered a lot new works on the streets of Soho, East Village and Lower East Side. My favorite newcomer is a mural by Logan Hicks on the facade of Burger King (Suffolk Street/Delancey Street). Recently I reported about an exhibition of the artist´s works called: "Love Never Saved Anything" (curiosity). It seems all his works are somewhat related with water which gives them a very special look.

I also enjoyed other works, often from anonymous artists, including some stencil graffiti (stencils).

Anyway, let the pictures speak for themselves. Enjoy.

Stock Market: Why The Pundits Hate The Rally

Take for instance Joshua Brown, a New York City-based investment advisor and owner of the influential blog "The Reformed Broker" (thereformedbroker). Joshua must hate the smooth rally. Who needs a pundit when almost every paper on the stock market is climbing smoothly? Who needs his sophisticated and experienced advice when indices like S&P 500 reach all-time highs? Why paying a pundit when Joe Sixpack, who invests in a simple S&P 500 ETF, gets richer and richer?

Poor Joshua.

Tuesday, May 27, 2014

Economy/Books: Amazon Versus Hachette - Who`s The Evil One?

(Drivebycuriosity) - There is a fight going on on the book market. Amazon.com is struggling with the french book printer Hachette, who is No 4 on the US market. Amazon wants to sell e-books really cheap, much cheaper than printed copies; publishers like Hachette want to keep the virtual versions expensive and sell them almost at the same price as printed books.

Amazon is now putting the French under pressure and is playing a rough game: According to the media they lifted prices for Hachette books, are shipping them at a slower pace and are recommending titles from other publishers. They also refuse to take pre-orders for coming Hachette books.

There is now an anti-Amazon front in the media. Newspapers and magazines like "New York Times", "Fortune" "TechCrunch" and others are taking side with Hachette and are bashing the online retailer (nytimes fortune). The Amazon bashers claim that they represent the interests of the readers & authors and lament that Hachette books are less available via Amazon now. But anyone can still get a Hachette book from an Amazon competitor. So what?

Amazon is acting in the interests of the readers (driveby). E-books have much lower costs than printed books because there are zero expenses for paper, printing, storing and distributing. It costs almost nothing to produce a virtual book. So, why are e-books often priced like printed books?

Publishers like Hachette are monopolists; no one else is allowed to publish their books (except you buy an expensive license which is usually done by publishers in foreign languages). Publishers have been abusing their monopoly power for decades by pricing books - and especially e-books - too high. According to the Wall Street Journal e-books have a profit margin of 75%! That means that 3 quarter of the selling price go to the publisher, not to the author.

Contrary to Hachette and other publishers, Amazon is not a monopolist. The online retailer has a profit margin close to zero and has to compete against Apple, Google and a lot of other online retailers. Soon the Chinese e-commerce giant Alibaba, who already dominates his home market, will arrive on the global markets (they already invested in ShopRunner, who competes against Amazon Prime). Why then do New York Times & Co. take the French monopolist`s part?

Amazon`s is turning the heat on Hachette because they want to tame the monopolistic power of the publishers. They want to force them to price e-books much cheaper, thus ceding a part of their 75% profit margin. If Amazon wins the fight not only the readers will benefit. Authors also would be winners because cheaper e-books mean more buyers, especially lesser known authors (those who aren´t in the bestseller lists) would find more readers.

Btw: The world is changing faster and faster - and the Internet is disrupting everything. If Amazon didn´t tame the publishers, then maybe Google, Alibaba or some newcomers would do that soon. I believe times have changed for monopolists like Hachette.

Disclosure: I am an investor in Amazon.com, user of a Kindle and subscriber of Amazon Prime.

Saturday, May 24, 2014

Economy: Why Robots Will Make Us Richer

Robots might even create more jobs. Take for instance Amazon.com. The online retailer uses more and more robotic systems in his gigantic fulfillment centers (geekwire). In 2012 the e-commerce giant bought Kiva Systems, a producer of warehouse robotic systems. In spite of the ongoing automation the number of jobs (workforce) in Amazon`s warehouses all over the world have been climbing significantly. It seems that robots are reducing costs which translates into falling prices creating growing markets & revenues for Amazon.com.

The Harvard Business Review also observes that "robots are starting to make offshoring less attractive" (hbr). They write "despite the doom and gloom, advances in robotics and associated technology are having a positive impact on local manufacturing and services and both sustaining and creating jobs" and "the more processes can be automated, the less it makes sense to outsource activities to countries where labor is less expensive" .

The economists John G. Fernald and Charles I. Jones from Stanford University, California and from the Federal Reserve Bank of San Francisco see an even better outcome (common overcomingbias). Recently they published their study "The Future of US Economic Growth", in the prestigious American Economic Review (May 2014) where they discuss theories which explain the "steady rise in living standards throughout much of the world (economic growth)".

Since 1870 GDP (gross domestic product = income) per person has been growing in the US annually around 2% on average. This growth can be explained (production function) by factors like physical capital (machines including robots & computers), labor (hours worked), human capital (knowledge & skills) and discovery of new ideas (inventions like computer, internet etc.). They add that "artificial intelligence and machine learning could allow computers and robots to increasingly replace labor in the production function for goods", meaning that the society can produce more things without increasing hours worked or even with a shrinking labor force.

Fernald & Jones conclude that "it becomes possible to replace more and more of the labor tasks with capital. In this case, the capital share will rise", and the growth rate of income per person and the long-run growth rate (now around 2%) will rise as well: "The possibility that artificial intelligence will allow machines to replace workers to some extent could lead to higher growth in the future".

If this is true we all will become richer thanks to rising incomes, falling prices for produced goods and investing into the stock market. On the long run stock prices accompany company profits which are climbing because of the growing economy (advancing demand) and rising efficiency (climbing productivity).

Thursday, May 22, 2014

New York City: Summer Of Rock 2014 - A Preview

I am looking forward to the "4Knots Festival" at South Street Seaport on Saturday July 12 (villagevoice). The free open air rock concert is organized and sponsored by the "Village Voice". They are continuing a tradition of annually rock events that started on Coney Island, the "Siren Festival". In the recent years I discovered there strong bands like "…And You Will Know Us by the Trail of Dead" and "Blond Redhead". This year the hosts announced 7 bands so far (2 stages) including "Dinosaur JR".

If you like it more rough you could go to "Punk Island" on Staten Island at Saturday June 22 (punk). They announce 50 bands playing on 7 stages - for free. Tons of punk, hardcore and such. Hallelujah!

If you had spend a lot of money you could attend "Governors Ball" on Randall´s Island from Friday June 6th through Sunday June 8th (governors). The huge festival has illustrious names like "Jack White", "The Strokes" and - my personal favorites - the uprising black metal band "Deafheaven", but most tickets are already sold out. Sorry about that.

And there is more. Brooklyn will have again its gigantic "Northside Festival (June 12-15) with 400 performers (!) at different venues, including "Titus Andronicus" (northside). A huge discovery tour for your ears.

Enjoy.

Wednesday, May 21, 2014

Books: The Year's Best Science Fiction: 30th Annual Collection, edited by Gardner Dozois

These and more questions are the topics of "The Year's Best Science Fiction: 30th Annual Collection", edited by Gardner Dozois and published in July 2013 (amazon). There are other best of the year collections but Dozois` compilation has been the market leader for 3 decades.

This anthology harvests the science fiction year 2012 and offers 29 short stories from prominent authors and newcomers. I managed to finish reading 15 of them:

3 stories are my favorites:

The thriller "Nightfall on the Peak of Eternal Light" by Richard A. Lovett and William Gleason transports the reader to the moon. A man seeks refuge on the earth`s satellite but he gets hunted by a hit man. The authors blend classical suspense with science, the tough conditions on the moon.

"Nightside on Callisto" by Linda Nagata tells about a group of old women working on a remote planet who get fiercely attacked by their construction and mining robots who`s minds have been hacked by a vicious AI.: An enthralling adventure in a high-tech environment.

"In the House of Aryaman, a Lonely Signal Burns" by Elizabeth Bear is a detective story (a "whodunit") set in an alternative world near-future India and deals with some weird results of genetic engineering.

I also enjoyed:

"The Finite Canvas" by Brit Mandelo, an intensive story about a tattoo artist who strikes a somewhat complicated relationship with a female professional killer.

"Steamgothic" by Sean McMullen leads the reader to an alternative world where people try to get an airplane engine to fly - driven by a steam. The story benefits a lot from the dry British humor.

"Twenty Lights to The Land of Snow" by Michael Bishop tells about buddhists who are traveling decades on a starship to a far away planet. The story is told by a young girl who might be the next Dalai Lama.

"The Stars Do Not Lie" by Jay Lake happens upon a kind of baroque world where science is restrained by the dictatorship of religious leaders. It is like Galileo Galilei told by Jules Verne.

"What Did Tessimond Tell You?" by Adam Roberts is about a cryptical scare.

"Old Paint" by Megan Lindholm is a heartwarming story about the relationship of a family with an artificial intelligence (AI) who happens to be a car. Funny.

"Weep for Day" by the Indian author Indrapramit Das focuses on a girl who grows up on tidally locked planet where one side has permanently sunshine and the other stays eternally night. It is an atmospheric story about dealing with the scary unknown.

"Macy Minnot`s Last Christmas on Dione" by Paul McAuley is about a visit at a somewhat exotic place in commemoration of a late father.

"Ruminations in an Alien Tongue" by Vandana Singh is a sentimental story about people who travel between alternative universes.

The collection shows the state of art in science fiction and offers a kaleidoscope of plots, ideas and styles and caters to a lot of different tastes. Dozois wrote for each story an introduction where he outlines the background and most important works of the presented author. At the beginning there is a lengthy summation of important events, trends and publications in the world of science of fiction in 2012. This and the nice selection of stories make the book a must for fans and collectors of science fiction.

Monday, May 19, 2014

Economy: What We Could Learn From Lehman Brothers And The Financial Crisis

(Drivebycuriosity) - The cow is dead, but it is still giving milk: "Almost six years after Lehman Brothers Holdings Inc. filed for the largest bankruptcy in history, triggering a global market meltdown, hedge funds are still feeding on its remains", writes Bloomberg (bloomberg).

Some hedge funds have made billions of dollars trading in Lehman`s debts. "Some parts were initially traded at 20 cents on the dollar in mid-2009 and are currently at the equivalent of about 150 cents", reports the media service. According to Bloomberg the bankrupt firm has paid out more than $56 billion to the new owners of her debts so far.

"Lehman filed for Chapter 11 in September 2008 listing $613 billion in debt after it couldn’t get U.S. government aid or attract a buyer" (bloomberg). Then Lehman - and the firm`s assets & debts - were treated as if the recession never would end and as there would be no comeback for the markets. The market prices of Lehman´s assets - which should cover her debts - had fallen to zero because of the recession and the gloomy sentiment and the market presumed that the debts weren`t covered any more.

Lehman debts are claims, which give investors the right to collect any income tied to the defunct firm´s assets like loans to other banks, home owners and other debtors. The market had assumed that Lehman wouldn`t earn enough money from her assets to finance principal and interest for her debts in the years to come which caused finally the death of the company. Lehman`s demise started a chain reaction and created a vortex which pulled the whole economy into a deep recession.

The gains which the debt owners have made since 2009 show that Lehman Brothers (and their assets) weren´t totally worthless as the firm went bankrupt. The revival of Lehman´s debts & assets also prove that the US Government and the Federal Reserve Bank made a huge mistake as they let the firm go bankrupt. If they had saved the bank - by buying her debts - they could have made the gains which are now earned by some hedge funds. They also could have avoided the panic which led to the general meltdown of the financial markets that caused the biggest recession since the depression in the1930s.

Friday, May 16, 2014

New York City: Street Art - Heroines Of Lower East Side 2014

As I have reported before this object has been used by New York`s Centre-Fuge Public Art Project, a collective of street artists who show there their own works and murals by invited participants (driveby). It seems that they are a catalyst for new developments in street art.

Now you can see there works by Lexi Bella. The artist sprayed a collection of portraits which she calls "Heroines of Lower East Side". According to heir Facebook site the series is "created to depict women from the 1700s to today who represent some of the amazing history, nationalities, and movements that have made the Lower East Side of Manhattan such a rich tapestry of culture" (facebook).

I guess you will recognize Debbie Harry, the head of "Blondie", you also might know Rosario Dawson from movies like "Sin City" (imdb). Explanations for the others you can find on this site (facebook).

But: Where is Lady Gaga - the most famous of the Lower East Side Girls?

Wednesday, May 14, 2014

Economy: Austerity Policy Leads To Lower Interest Rates

1. The US economy is getting stronger what usually leads to higher interest rates

2. The Federal Reserve started tapering and is buying less government bonds (exit from QE3).

I suppose that the falling interest rates are a response to the austerity policy of the US government. Austerity means that the government spends less money. Uncle Sam needs less loans to finance the expenses and the public debt is shrinking. Therefore the government is issuing less government bonds (treasuries) to finance its spending. The shrinking supply of government bonds raises the prices for government bonds which is equivalent to falling interest rates.

There is another interpretation for this phenomena: Interest rates are the prices for loans. As always the price is determined by supply and demand. The demand for loans is shrinking because the US government (the largest debtor of the world) needs less money to spend. Therefore the price (interest rate) is falling.

This throws a new light on the Fed´s tapering: They are buying less government bonds because the supply of these assets is shrinking. Therefore less bond buying by the Fed doesn`t necessarily cause rising interest rates.

Thus the austerity turns to be positive for the US economy because the interest rates for loans other than treasuries are also falling (less competition from government bonds). For instance mortgage rates also are sinking - against the forecasst - which is good for house buyers and should stimulate the market for homes further and encourage constructing (chicagotribune). The low interest rates are positive for the whole economy.

Sunday, May 11, 2014

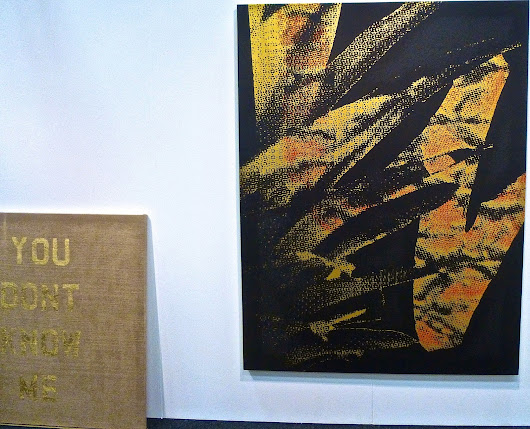

Culture: NADA, Art Fair @ Basketball City on Pier 36, New York City 2014

(Drivebycuriosity) - This weekend New York City has an orgy of art events. The metropolis is hosting "Frieze New York", one of the largest global art fairs, and all over Manhattan there are more than a dozen satellite art shows.

This Friday I reported about the "Downtown Fair" in Midtown Manhattan (driveby).Yesterday I visited NADA NYC @ Pier 36, which is normally used as basketball hall in Southern Manhattan (newartdealers).

The fair is organized by the New Art Dealers Association and hosts more than 80 US and foreign galleries. I didn`t see any famous names represented there but the works of a legion of uprising and interesting artists.

I indulged in the diversity of the paintings, sculptures and video displays and enjoyed the often fresh and surprising ideas. Watching the crowd of spectators and art collectors also was a lot of fun.

Here again a collection of my favorites. Let the pictures speak for themselves. Enjoy!